The COVID-19 pandemic has forced governments across the world to lockdown their nations in order to contain the spread of virus and control the increasing numbers of infected people and the surging death tolls. With people from around the world practicing physical distancing by staying inside their homes, the industries and businesses across the globe are experiencing crippling effect of the COVID-19. As day-to-day needs of the people have shrunk down to only essential commodities, many industries are struggling to survive.

Considering the FinTech industry amid the COVID-19 crisis, companies are leaving no stones unturned while working on introducing new products to cope up with the impact of the pandemic. With businesses leaving the brick and mortar venues due to the lockdown, they are now leveraging technology on all fronts. Thus, the FinTech industry is the need of the hour bearing in mind that several businesses will now have to resort to taking their businesses online.

Due to the COVID-19 pandemic, the FinTech industry is most likely to witness an emergence of new sectors in the digital payments, while the sectors that used digital payments rigorously see a downside due to the lockdown.

| New sectors boosting digital payments | Old sectors hindering digital payments |

| Small grocery stores | Airlines, Travel, Tourism |

| OTT- Netflix, Hotstar, Amazon Prime | Hospitality |

| Payments for Healthcare & medical needs | Multiplexes |

| Restaurants & Bars |

4 Ways COVID-19 has Impacted the FinTech Industry:

Increased Demand for Contactless Payments

The fear of the COVID-19 spread has led to increase in demand for contactless payments in every industry. In the times of COVID-19 crisis, people across the globe are seeking contactless payment methods and mobile financial solutions. Even while buying essentials from a nearby grocery store, people insist on making contactless payments. According to Mastercard in which 17,000 people from 19 countries were interviewed, 74% said that they will continue using contactless payment even after the COVID-19 pandemic is over. Further, 82% respondents claimed that they view contactless as the cleaner way to pay.

Impact on Capital Funding in the FinTech Industry

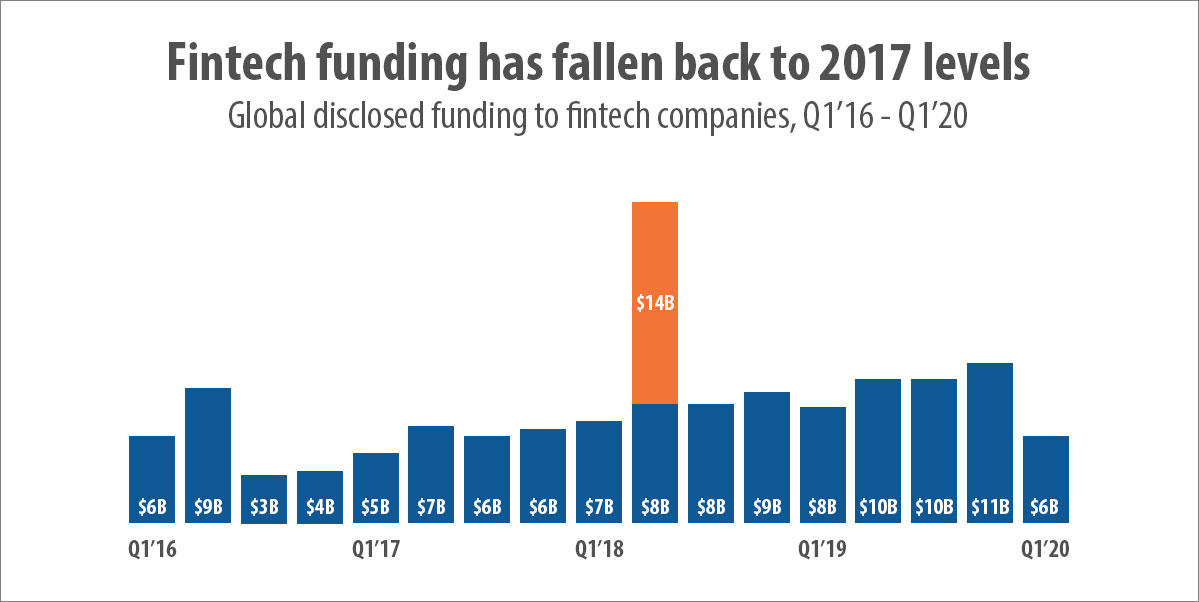

With markets are being incredibly volatile due to the impact of the outbreak of COVID-19 and the consecutive lockdowns across the globe, investors of FinTech industry too have become cautious in lending their money to startups. As per a report by CB insights, the total funding to FinTech companies for Q1’20 would settle at around USD 6B —a level not seen since 2017.

Consumers Less Willing to Invest Their Savings:

In these unprecedented times the willingness of consumers to invest their savings in anything apart from essential goods has decreased drastically. This has a major impact on the FinTech industry as it focuses on consumer investments. Due to increased cautiousness, even those investors lucky enough to be relatively insulated from the economic fallout may choose to put their money in safer options for the time being.

Companies to Switch to Digital Systems:

With countries continuing to resort to self-isolation and businesses are working remotely to curb the spread of the deadly virus, banks have started incorporating better digital solutions. This gives an opportunity to FinTech companies as they are well-positioned to offer digital solutions that can replace traditional systems.

COVID-19 to Accelerate Digital Revolution in Financial System

COVID-19 will turn out as an agent that triggers digital transformation in the financial system as financial institutions will turn to tech companies rather than in-house solutions to drive the transformation. Also, the COVID-19 outbreak is an accurate time for traditional financial companies to add new functionalities to its products and offerings and embrace modernization by collaborating with Fintech firms.

With FinTech solutions such as MobiFin Elite, banks and financial institutions can propose fraud resistant and scalable solutions to their patrons, designed to automate various financial and banking activities, encourage banks, financial institutions, and enterprises to expand their business opportunities. With a robust and secure Digital Banking Platform, the platform delivers FinTech solutions to a range of user segments around the globe. The platform allows MNOs, MVNOs, mobile wallet operators, banks, financial institutions and aggregators to make their own customized digital ecosystem.