Africa’s banking market is one of the fastest growing, second-most profitable of any global region, and a hotbed for innovations. Fintech has a key role to play in enabling and promoting development of financial sector in Africa this includes both financial institutions and digital banking platform providers. An organized regulatory environment in a developing market is crucial for both generating mobile financial services and reducing the potential downsides.

What started as an idea to generate a regulatory sandbox concept, has evolved into a more structured initiative with an objective to create a network of regulators who collaborate with a single aim of laying out policy details and conduct innovative regulatory trials.

Let’s start by understanding what a regulatory sandbox is.

What is Regulatory Sandbox?

A Regulatory Sandbox is a framework by regulators that allows small scale, live testing of innovations by companies in a controlled environment so as to avoid the financial risks and liability.

Any new innovation or idea, if found viable in the sandbox and is further approved by the regulator, can be made available to public. Currently in Africa, out of 54 countries, only 3 (Kenya, South Africa, and Sierra Leone) have regulatory sandboxes. Some more regulatory sandboxes are either launched or are in the design phase (Sierra Leone, Mauritius, Mozambique, Uganda and Nigeria). Three of these are a direct output of FSD Network support. This shows that there’s a lot of scope in the African region when it comes to adapting to alternative finance.

African Fintech Market and Regulatory Sandboxes

African region has been slower than the rest of the world when it comes to adopting financial technology, however now the scenes have changed with several countries launching regulatory fintech sandbox to support the development of mobile banking solutions. A recent survey by World Bank and CCAF in more than 110 jurisdictions, including 24 in Africa, underlines this sentiment. 79% of the regulators are expecting a positive impact on SME financing, 65% are expecting a positive impact on consumer finance, and 56% responded positively to a more general question on the impact on financial inclusion.

We must note that this can only be successful, when we foster collaboration between regulators, non-traditional market players, licensed financial institutions and other partners to pilot innovative products, services or solutions. Protective banking regulations have prevented the advent of a digital emergence especially in Africa. But sandbox provides an opportunity to Innovate and at the same time Regulate. The unification of these entities will certainly help the digital transformation and also bring the change in the lives of the people.

Another interesting factor is the emerging sub-sectors from the Sandbox ecosystem – Biometric identification and Authenticated transactions. Safety has been the crux of a successful digital payment ecosystem and biometrics ensure customer data is stored in a secured manner. The various applications of a smart biometric process involve capturing maximum and exclusive data points from a customer. This data minimizes possible identity theft making sure customer has a secured payment experience while helping the banks and FIs create a comprehensive database. A multi-layer authentication similarly ensues confidence in customer over the quality of service while keeping fraudsters at bay. While onboarding, all 4 modalities of face, palm, fingers and retina can be captured and while authentication of transaction, any of the modalities can be used to verify the same.

While an effective sandbox is supported by biometrics and secured authentication, it becomes equally important to protect this consumer data from prospective poachers. Secured data is the way to win trust of the users when looking to upgrade the market as a whole.

The State of Data Privacy in Africa

Africa has usually been used as a testing ground for several technologies while the actual technology remains elusive. Customer’s personal information, however, is a valuable commodity in the global market. 24 African countries, out of 53, have finally adopted laws and regulations to protect personal data, and the number is slowly rising. For instance, Nigeria - the continent’s biggest economy and most populated country - adopted its first Data Protection Regulation in early 2019. In 2020, around twenty African countries are going to the polls, and citizens will use their voting rights through biometric voting systems. In the case of Africa, most of these voting systems are produced by Western companies through lucrative contracts with African governments. The need is to monitor and safeguard this data from the clutches of purported data thieves.

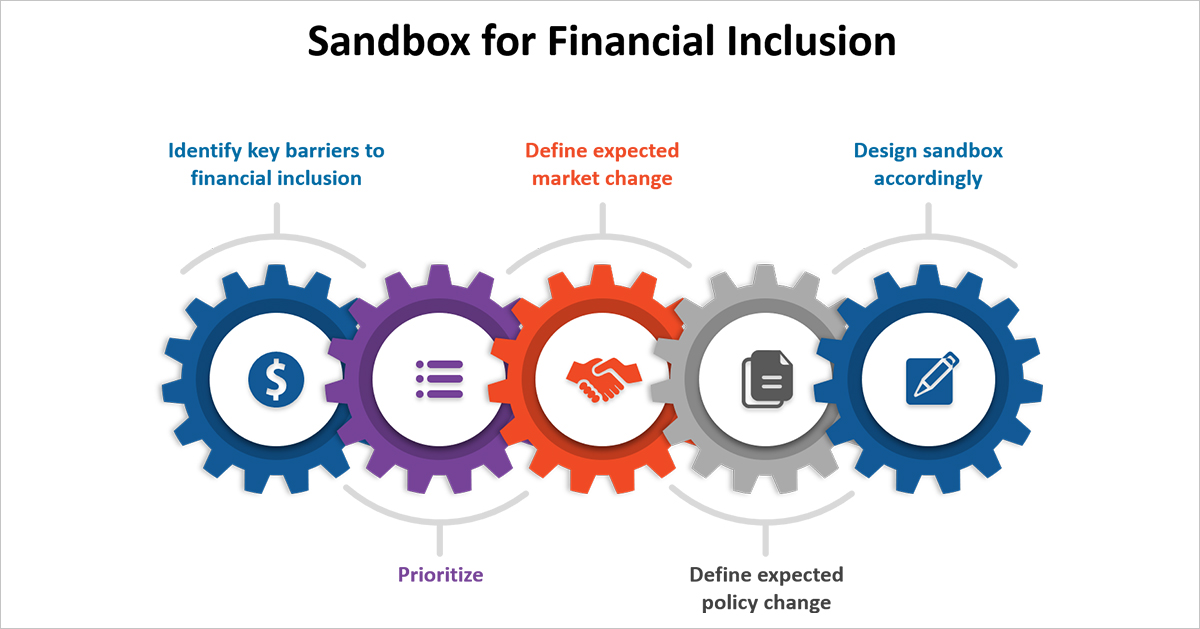

Sandbox for Financial Inclusion

Another factor that supports the setting up of a stable financial ecosystem and in fact plays a big role in economic evolution of the African subcontinent is financial inclusion. An effective sandbox can be determined by the range of reforms it can provide, both basic (e.g., enabling nonbank e-money issuers) and advanced (e.g., regulating ICOs). A successful Regulatory Sandbox lets regulators to focus on implementing regulatory changes thereby bringing financial inclusion while understanding the processes and supporting implementation.