Earlier the banks were competing with other banks in the industry, but now the scenario has changed with the advancement of technology-driven by digital ecosystems. Financial Institutions are entering the banking space with high-end technologies. Banks are highly regulated and are facing hurdles when innovating with technology, while fintech companies in the B2B market are extremely agile technology companies operating in a relatively less regulated sphere with fewer compliances compared to banks.

The pandemic has contributed towards the digitization of the banking industry. The number of physical transactions has dropped, and users are increasingly moving to manage their financial requirements online. The fast-evolving regulatory framework and digitization offer greater connectivity and redefine the financial ecosystem between organizations.

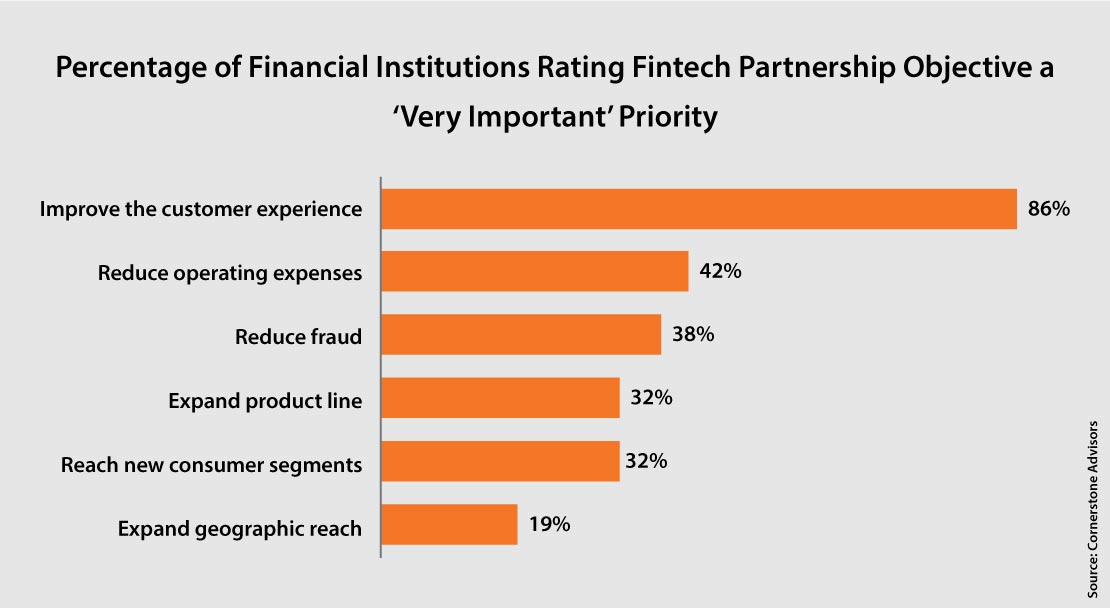

The 86% of banks and credit unions that plan to collaborate with fintech have emphasized 'improved customer experience', followed by reducing operating expense and fraud. Just about 32% considered ‘expansion of the product line’ as a top-most priority.

In recent years, the banking sector has undergone some significant transformations. This transition has become inevitable with fintech companies entering the market. Banking-as-a-Service (BaaS) is at the center of this market change with the development of new products, channels, partnerships, and opportunities.

Banking-as-a-Service – How it Works?

BaaS is an end-to-end process that uses APIs (Application Program Interfaces) to connect fintech companies and other third-party organizations to a bank's system. This enables open banking services while allowing organizations to construct innovative financial services on top of the primary bank's regulated framework.

Fintechs can swiftly develop novel digital banking services thanks to the BaaS model. Licensed banks provide access to their infrastructure through APIs in a cooperative and collaborative manner, allowing new customer-centric solutions to be developed easily with minimal capital investment.

Compliances can be integrated into a BaaS system, allowing fintech companies to comply with even the most stringent regulations. A fintech may comfortably and cost-effectively enter strict regulatory areas with a solid BaaS platform. Services can be arranged and offered according to the preferences of customers.

Using APIs, BaaS is technically viable with just a few code lines. APIs and webhooks allow the bank's server to connect with the service provider, and the customer uses the service provider's website or app to conduct financial transactions. The critical aspect to consider is that the service provider acts as a channel for the bank and does not touch any of the customer's funds. BaaS is indeed an outstanding demonstration of white-label banking, which allows a bank to expand its outreach into new regions and markets. However, success in modern banking necessitates the smart model and technologies.

BaaS and Multi-Tenancy

Expansion of shared services across the banking industry has changed the way banks develop and provide services. For a core banking system to involve with BaaS, it must be cloud-based and support multi-tenancy. Multi-tenancy enables a single institution to manage several businesses effectively over a single platform, all while keeping the data segregated. Multi-tenant systems are also efficient and safe and can manage the most complicated financial organizational structures. The application software and a single database are shared by all the tenants, but the data for each tenant is separated and inaccessible to others.

The technological, financial, and long-term advantages of BaaS and a multi-tenant framework include:

- Reasonable, and predictable costs that are correlated with success parameters. Banks can charge for services without having to invest heavily in technology on a regular basis.

- Easy integration enabled by the use of APIs in a cloud environment, and all network consumers and participants are synchronized in real-time.

- As there is only one version of the software, maintenance and upgrades are simplified.

Choose the Ideal BaaS-Fintech Partnership

As the need for a seamless digital experience surges, the collaboration between banks and fintech organizations is bound to gain prominence with both the parties accessing each other’s strengths to make their offerings more fulfilling. The new banking era will witness both competition as well as a mutually beneficial partnership.

Technology, collaborations, and finance are all important components of a successful BaaS partnership, but they're sometimes disregarded in favor of product and marketing. Prioritize scalability by making a futuristic plan. The cheapest or most straightforward option may come back to haunt you later.

Panamax's Banking Suite provides a comprehensive digital banking experience with cutting-edge functionality and end-to-end solutions that enhance operational efficiency. Banks and financial organizations can deliver modern banking services to their consumers and simplify online banking with our banking suite. Our clients benefit from our secure financial ecosystem that is anchored by a robust platform architecture redefining financial security.

Related Blogs

Rise of the New Banking Model

The New Age Technologies Reshaping the Banking Industry