For any nation to ensure holistic development of its economy, the most crucial aspect is its rural development. Lately, the developing countries across the globe are focusing on rural development to ensure upliftment of their economies. In ensuring continual development of remote/rural areas and its populaces, central government bodies, local government bodies and the financial institutions play the primary role. While the government authorities are responsible for developing the rural areas with better infrastructure facilities, financial institutions play the role of leveraging support by facilitating financial inclusion to the rural residents.

What is Financial Inclusion?

Financial inclusion is a set of measures put in place to bring all people regardless of their income level into a formal economy. To enable government bodies to reach out to rural vicinities, it is important that every person; however poor, is included in the ecosystem. In developed/urban spaces, banks reach customers by opening multiple branches and ATMs. However, the reason behind the inability to reach out to rural customers is that opening a bank branch in rural/emerging markets requires high CapEx/OpEx and the branch fails to generate enough ROI. Further on, it is difficult for rural customers to operate a banking application and gain access to banking services on a mobile phone. This leaves a big chunk of population unbanked.

Need for Financial Inclusion in an Economy

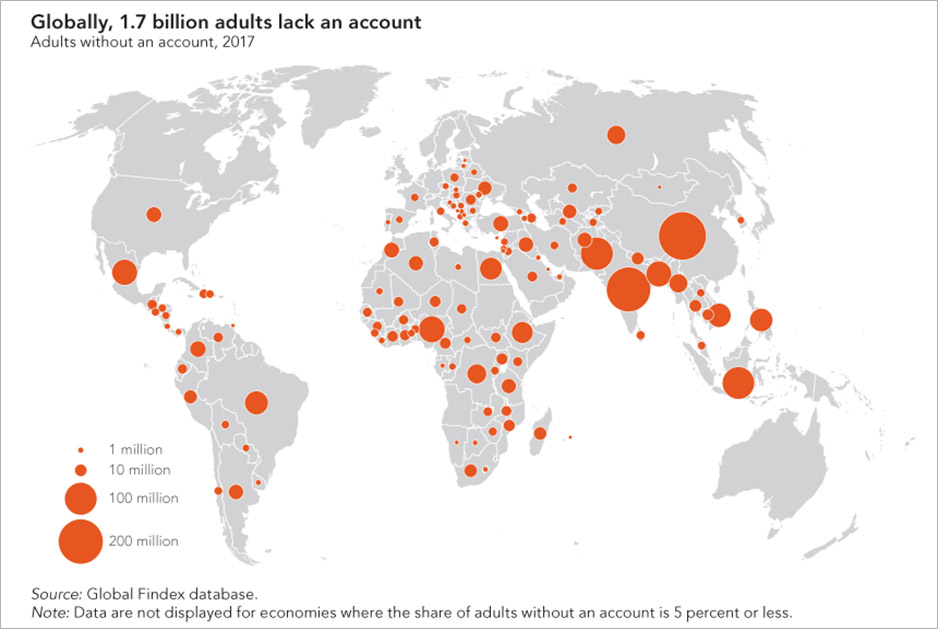

According to a report by the World Bank, nearly 1.7 billion adults in the world continue to remain unbanked.

Without financial inclusion of populaces from rural areas regardless of their economic capabilities, holistic development of a nation cannot be achieved.

Here are the 3 key needs for financial inclusion in an economy:

- Providing access to reliable daily payments to people working in informal industries in rural areas

- Providing access to credit that can allow investments for small-scale businesses to people in rural areas

- Providing ways to save cash to mitigate future risks

Why Agency Banking?

Banks play the most crucial role in enabling financial inclusion in an economy. However, due to issues like the cost of delivery of a bank system and availability of resources, banks cannot reach out to such underserved/remote areas. One of the most reliable solutions in such scenario is Agency Banking.

Agency banking solution is an effective way to include the vast unbanked and underbanked population into the banking system. A trusted agent would be worth a lot more than an imposition of financial institution in the areas where financial enlightenment is scarce. Agency Banking entails creating a network of agents or non-bank retail providers that bring essential banking facilities to the doorstep of the remote populaces. The agents carry Point of Sale (PoS) card readers with barcode and biometric scanners or a mobile phone which can be used to carry out various banking services such as cash-in/cash-out, P2P money transfers, remittances, balance checks, loan installments repayments, mini statements and much more.

How Agency Banking Facilitates Financial Inclusion?

Increasing scope in the rural banking sector has led to a surge in the importance of agent banking. Agent bankers increase the reach of financial institutions at a very low cost whilst enabling financial inclusion. Thus, it is important to understand how and to what extent agency banking solutions can promote financial inclusion. Agency banking is enhancing financial inclusion of the unbanked by: -

- Providing basic banking facilities like deposits, withdrawals, remittances at the doorstep or at a place closer to rural population than the banks.

- Providing low-cost banking services which wouldn’t be possible for the rural banks.

- Ensuring round the clock availability unlike rural bank branches that work for limited hours in a day.

- Introducing the unbanked to various banking forms through mobile banking technology.

- Providing bill payments and other utility payment facilities.

- Increasing the customer base for the banks by using their wide social contacts in remote areas.

- Developing a good relationship with the rural customers and influencing them to make frequent use of banking services. A branch may seem intimidating to the people in remote areas due to the lack of know-how and would not provide the same comfort level.

Read Also

Why is Agency Banking the Silver Bullet for Financial Inclusion?

Agent Banking: Transforming the Banking Industry

Deploying Agency Banking Services

By providing numerous benefits to the rural banks and the rural customers, agency banking has attained a prominent place in the rural banking sector. Agent Bankers help the banks reach those remote areas and customers where their branches cannot reach. Therefore, while choosing an agency banking solution, a bank must look for a service provider that will assure ease in creating new accounts, new applications, edit loans and assist efficiently in a lot more, remotely. While attempting to tap the rural customers, it is imperative for banks to deploy agency banking services that can not only broaden their horizons but also promise ease and efficiency in serving remote customers.