Mobile Money is booming across the globe with a success story to shout about in every country. Kenya is an innovation and technology hub for Mobile Money since the launch of M-Pesa in 2007, which alone managed to flow 43% Kenya’s GDP with over 237 million p2p transactions. Other countries are showing similar results too; with smartphone and data penetration growing, customers are now finding it convenient & secure to do transactions online or through their smartphones.

Growing numbers and revenue potentials influenced both Banks and Telcos and tempted them to invade in each other’s territory to get their pie. Bank and Telcos represent two sides of a coin and with every toss, they want to win and play the game their way. The conflict involves the undefined roles of banks and telcos in financial services delivery, which are like “two gorillas in the jungle”, both fighting to expand their territories. Both these giants, loaded with stealth weapons are equally dominating and strong in their arenas. Banks with practical hands-on experience manage financial services & transactions with utmost security; whereas Telcos with a huge customer base and agent network, master in volume transaction.

Both are very crucial aspects required to manage the new era of Mobile Money services. The need of the hour is to offer financial services to a huge customer base, primarily the ones residing in rural areas with no direct access to financial services, empirically known as “Agency Banking”. Even though there are cooperative banks and regional rural banks in villages but most of them have failed to make an impact due to mismanagements and inefficient functioning methods.

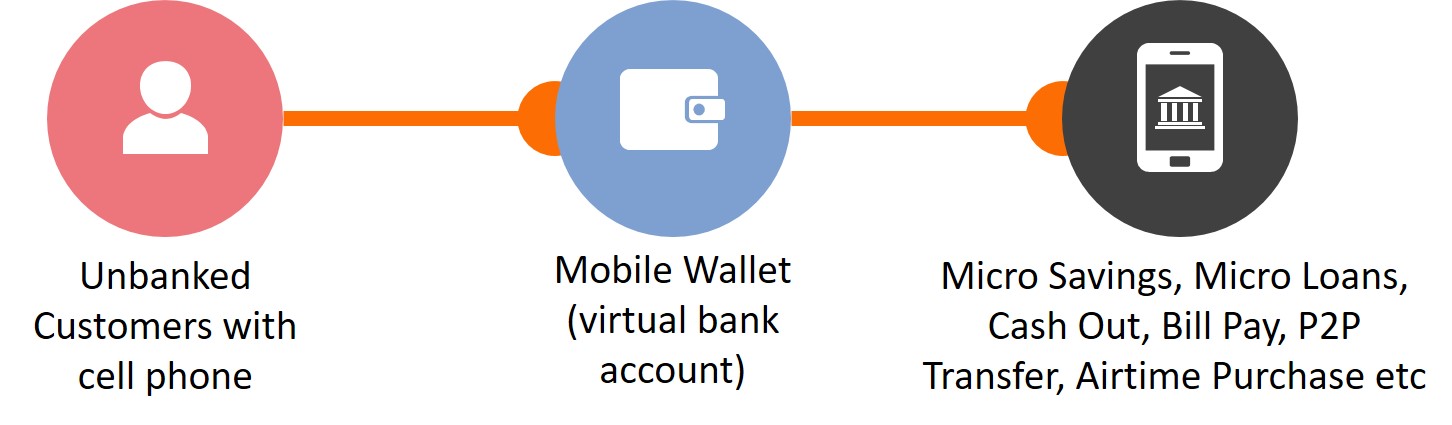

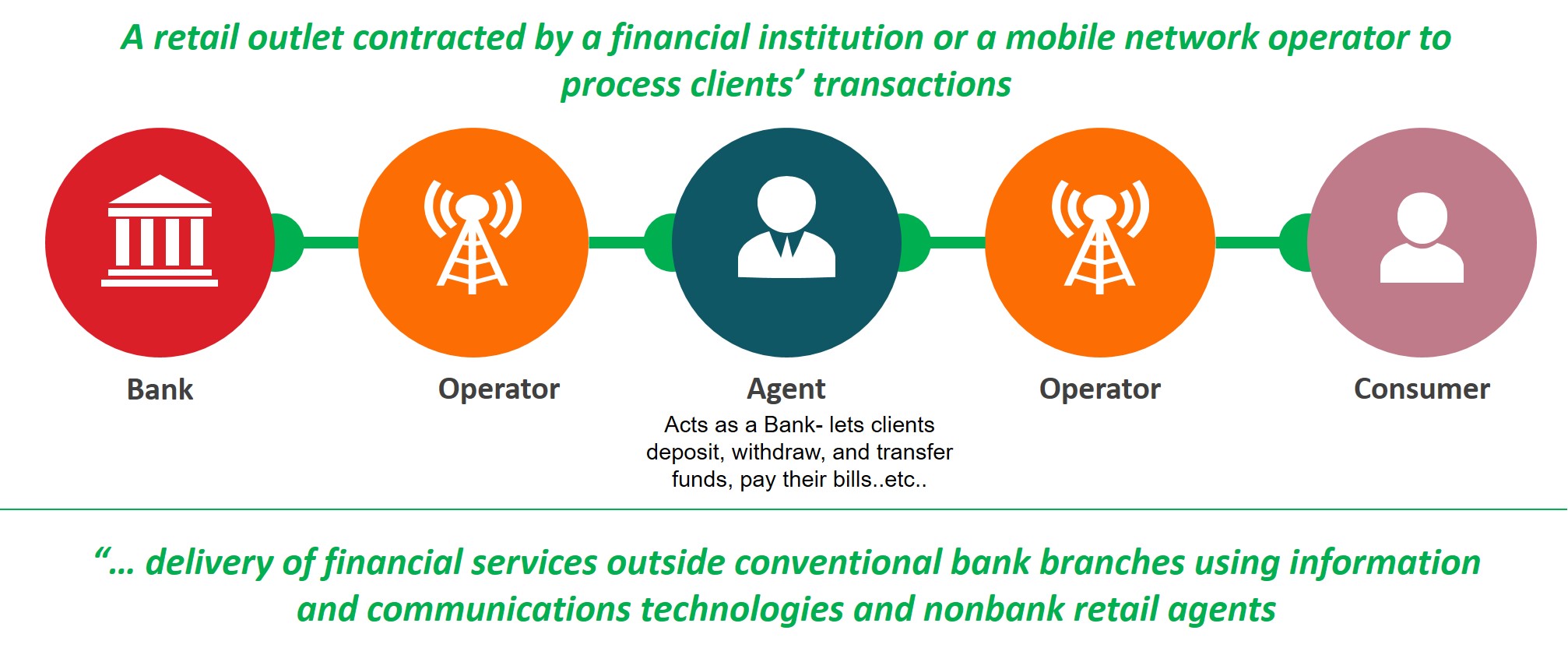

Agency Banking is offering financial services through Agent network, i.e. banking services using Telco’s Agent Network.

It’s like the best of both worlds and would be in the best interest of the end customers, where retailers act as agents to facilitate cash handling and customer due diligence for account openings. Here the reachability of agent is used to address customer’s financial needs. Agents are equipped with tools like, Smart Mobile Apps, Biometrics, POS, etc. to manage the complete financial requirements of customers and act as Sub-Bank for customers. Where customers can walk-in anytime, can ask for:

· Account Opening

· View Balance / Statement

· Mobile Money – Wallet Transfer (Cash In / Cash Out)

· Request for Cheque Book, Stop Cheque Request and so on…

Business model is simple but the question that always remains unanswered is ‘Who would lead / manage this?’ Well, this depends on the country regulatory, but in most of the cases witnessed by us in Africa it’s a Telco led model. Banks are pushing it hard to get the required approvals and get back the financial control.

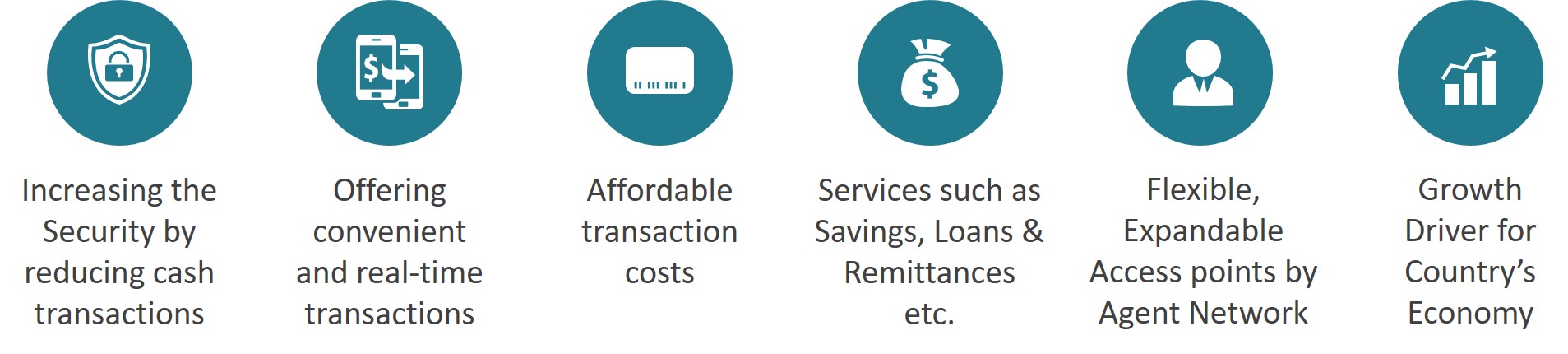

The saying “when two bulls fight, the grass suffers" is changing to “when two bulls fight, the grass thrives". Doesn’t matter if it’s a Bank-led or a Telco Led model, the agenda is clear – enable poor people to access financial services at affordable rates and means. Successful deployment would result into below listed benefits to End Customer, Agent Network, Service Providers, Regulatory, and Country.

All this seems very candid, but the fact is Agency Banking would require great control over the agent network, service offering, last mile fund transfer, highest standard of security, and more. In the absence of a robust system, the entire model would fail or not gain the expected momentum. Be it Bank or Telco, they would require upgrading their tools to meet the requirements of Agency Banking. A solution that can seamlessly integrate with their current infrastructure and effortlessly manage the complete hierarchy of channel partners, commissions, products, taxations, compliance, and security.

We at Panamax, offer Agency Banking Solution, if you are looking for one, do get in touch with us.