These are interesting times to be in the payments industry. While the world is battling with both health and economic challenges, the payments industry has an uphill task to ensure more and more people can take advantage of the cashless boom. This is definitely not a new concept but cashless has become ‘the’ thing since social distancing measures have come into place. It would be unfair to ignore the importance of a National Financial Switch when discussing the measures to go cashless. The switch has proved crucial in promoting financial inclusion, economic prosperity, and supporting innovation in fintech solutions.

The current payment ecosystem is driven by the individual incentive of each bank and does not take the advantage of a collaborative approach of a market-driven incentive. During a card payment process without a national payment switch or a national financial switch in place, the card issuer and the acquirer need to have a direct relationship with the card scheme. If the card issuer and acquirer are not from the same institution, they cannot interact directly. They must be routed via the card schemes for any payment authorization requests, thereby paying a fee to the credit card company. Do you see how this increases the cost of a payment cycle while complicating it for the customer?

A national payment switch is the answer to these fundamental drawbacks that ensure financial stability by inculcating a cost-effective payment system and creating a level playing field for all the stakeholders involved in a payment process. Upgrades to the financial technology and global financial liberalization have led to major updates in the architecture of large-value, retail, and securities payment systems, as well as the processes, and procedures followed by operators, administrators, regulators, and users of the systems. This system has so far been implemented in several countries across the world and several others are joining the movement.

Let us understand what a national payment switch is and how it is helping governments create an inclusive atmosphere for digital payment stakeholders to flourish.

What is a National Payment Switch?

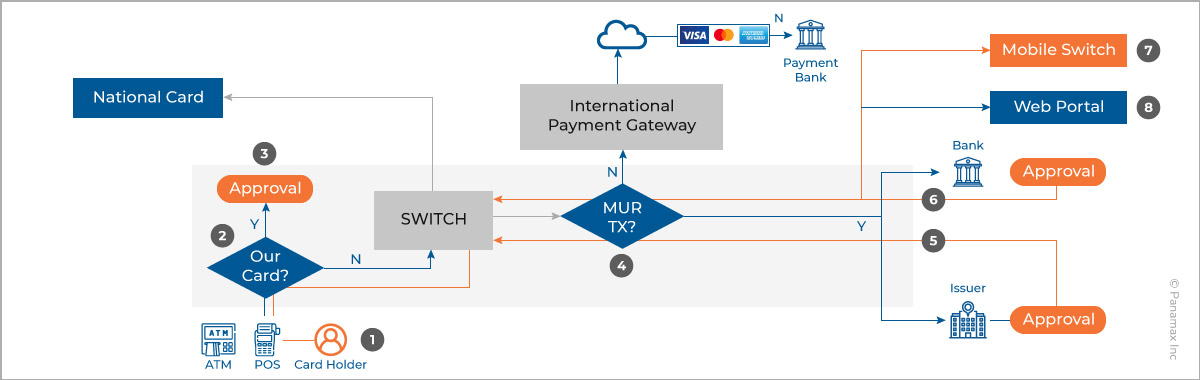

A National Payment Switch interfaces with any PoS system, ATM, Mobile Payment System or e-commerce portals, consolidate all the transactional details and further channel them to payment processors for authorization and finally settlement. A National Payment Switch essentially simplifies the card payment process allowing buyers and sellers of financial products and services to make transactions across access channels.

The switch routes all transactions irrespective of the cards used to a central switch for settlement at the bank. The National Payment Switch has a single interface with all global card payment processors such as VISA, American Express, MasterCard, Diners Club, and so on.

Stakeholders of a National Payment Switch

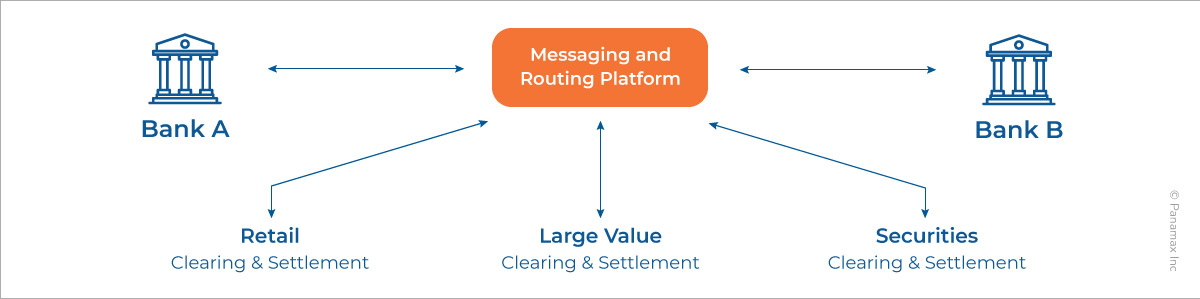

Clearing and Settlement

Clearing refers to the transmission and reconciliation of payment orders and the establishment of transaction to be settled. Settlement on the other hand takes care of the obligations - the respective debiting and crediting of the accounts of the parties to the transaction. The integrity of global financial system depends on the correct accounting of every transaction undertaken; therefore, the stability depends on the reliability and accuracy of the clearing and settlement systems.

There are three primary clearing and settlement systems.

- Retail systems - are liable for the processing of small-scale financial transactions usually lesser than $1 million.

- Large value systems - are liable for the clearing and settlement of larger transactions.

- Securities systems - handle the clearing and settlement of securities, like common and preferred shares, bonds and other sorts of instruments.

Operational Flow

Services Offered

A national payment switch facilitates

- Cash Withdrawal

- Balance Enquiry

- PIN Change

- Mini Statement

Supporting Cashless through National Payment Switch

National payment systems are vital to the integrity of the worldwide economic system. Technology and globalization have facilitated the rapid climb of systems for processing noncash electronic transfers between parties located across the globe. The payment system in any country will have a few retail, large value and securities settlement systems that link into the systems of other countries through various linkage platforms and correspondent relationships. The actualization of a risk, like a stakeholder defaulting on a transaction, has the potential to spread throughout and thus imperil the system's integrity, making the payment system a priority for central banks and other key institutions the financial ecosystem.

Choosing the Right Partnership

It is crucial to select the right associate when developing a dependable national payment switch. Here are some deal-breakers that should be kept in mind when finalizing your partner:

- What are the geographies of their operation?

- Are they managing any complex projects?

- What are their existing deployments?

- Technology used

- Security of the platform

- Adherence to the regulatory framework

- Cost of deployment

- Credibility in the market

- Scalability of platform for technological upgrade

- Capacity and functionality of the switch

Panamax’s National Payment Switch checks all the parameters providing a direct interface with banks’ clearinghouses thereby offering seamless customer experience, and saving costs for the government. The switch provides a single interface with all global card payment processors that enter into an agreement with it for transaction processing of their locally issued cards. Panamax’s national payment switch is backed by a market experience of over 30 years in providing switching, billing and fintech solutions to customers worldwide. The intricate understanding of the financial ecosystem makes Panamax an ideal choice for deploying a financial switch anywhere in the world. Schedule a free demo with our experts now and understand how to manage the customer experience during a payment cycle.

Related Blogs

WhatsApp Banking – Making Banking Accessible

5 Key Trends Automating the Mobile Banking Experience