Fintech is enhancing, innovating, and exploring the possibilities of automation for the delivery and use of financial services vis technology. As we evolve with technology and our need as consumers changes, so does the function around finance. In this journey of evolution and disruption, physical financial services have moved to Digital Financial Solutions, involving extensive coordination between multiple programs/channels/software. And this well-orchestrated multifunction is solely dependent on APIs or “Application Programming Interface.”

APIs are well-endowed software intermediaries which help mediate communications between programs thus resulting in offering a seamless customer experience. These APIs help fintech with modernization, offering customer-centric products that fill the gap between legacy banking and the new-age technical offerings.

The Future Beyond The Old and Obsolete

In the post-pandemic era, under duress, the payment solutions started depending on strategies that constantly take on the challenge to transition every penny and build a cash-free environment. While the industries faced the blunt off pressure to maintain the levels of service while physical distancing and obeying the new regulations, fintech brilliantly used its existing digital financial solutions, previously hibernating because of low functionality by choice, and turned them around to retain the existing customer base and offer the sense of security to the new customers.

While the industry wants to offer services that have a quick turnaround it becomes quintessential that the fundamentals structuring new competitive programming (CP) are adequate. At first, CP was considered only a sport but in the past decade, CP is looked at as a faster way of solving complex projects, one component at a time and focusing on space complexity of the code, data structures, and most importantly time. In addition, the new age offerings deliver the requisite multi-layered security to protect the data consumers, defend any meddling with financial transactions and manage the optimum environment to help with the sanity of the service provider.

The dawn of API in banking has resulted in significant changes in operations by enabling corporations to help simplify finance, be it sharing data, integration with systems, and personalization of services. The fintech sector is one of the most rapidly growing tech sectors, owning flaunt-able innovations and enviable customizations on offer.

For example, an app on your phone can connect you to the bank and you can use a universal ID for mobile payment solutions, then again, the same ID is used by third-party apps to help you make transactions in a seamless environment where OTP in your messages is read by the apps.

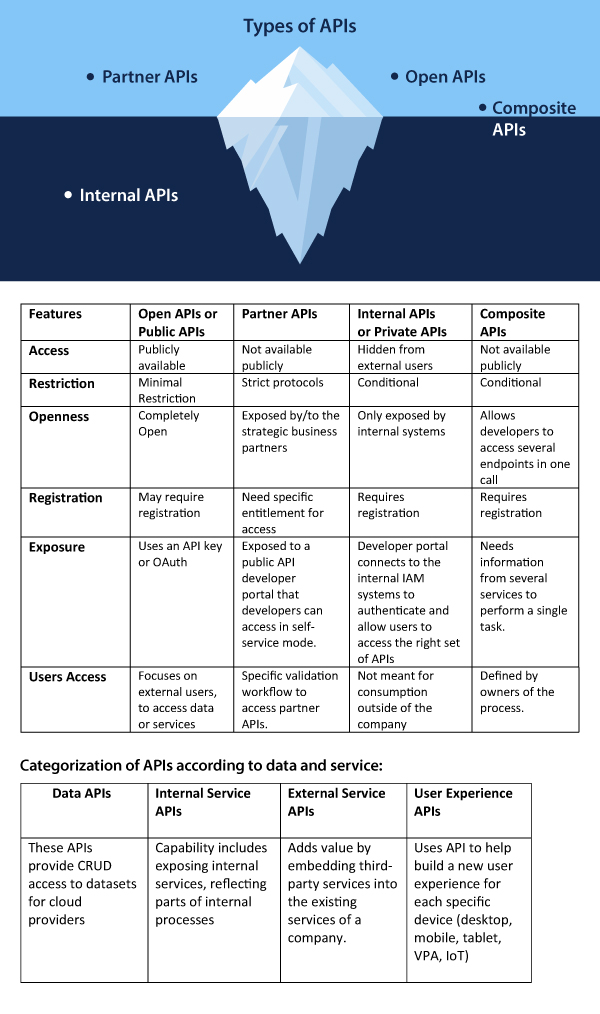

Types of APIs

Benefits of APIs

- Cost-effective: Those days when banks used to only maintain an account are gone. APIs give us easy access to a range of tailor-made banking services, right from the comfort of our homes.

- Data Accessibility: In this new era of automation, we can now use our mobile phones to control all aspects of our lives through data easily available to us.

- Growth-led: API and the numbers representing the growth in the past & present speaks volume. It seems the multi-device experience via a single platform ensures future growth and development too.

- Empowers Fintech: Previously there was a veil of secrecy as if finance is a taboo topic especially the customer detail. It may seem an alluring proposition, but in return, banks lost accessibility. APIs give customers control of their privacy as well as access to numerous apps to take care of any requirement on highly secure platforms online.

- Real-time access: Customers now have access to the banking services independent of time and location. APIs have been delivering the promise of a secure environment for real-time money transactions. They are also taking into consideration the data available and personalizing services unique to the financial requirements of the customers.

- Fast and efficient operations: API empowers efficiency by eliminating the need for physical visits as well as utilization of data accessibility.

Use Cases of APIs

After ages of being in control of products, processes, architecture, and services banks may not be the fastest to let go, but APIs are upping their game by bringing in the opportunity to expand the scope of access to different distribution channels while consistently and successfully experimenting with ways to improve customer experience.

- Digital Banking: APIs offer automation of all the possible functions of traditional banking heavily dependent on technology-aided services like managing checking accounts, credit cards, and more.

- Account Data Aggregation: APIs enable organizations and/or a person to view data from disparate financial accounts in one place.

- Information Verification: API aid fact-checking vis automation.

- Payment Options: APIs process, simplify yet expand the scope of payment by offering customers a streamlined checkout process and multiple payment options.

- Peer-to-Peer business: APIs help P2P with significantly lower operational costs automate the lending process and shorten the wait time for loan approval & disbursal.

- Investments: APIs simplify investments and provide access to eager investors.

- Scope of possibilities: Fintech offers an open marketplace for collaborative innovation with endless possibilities.

Banks and Fintech- Finding a Leeway within APIs’ Purview

Over the past years, both fintech and traditional banking organizations have understood that by locking horns both will the opportunity to gain from their unique set of strengths. Thus, there is the birth of a more level-headed discussion and the option of collaboration on the table promising more customers than ever possible.

As per the WRBR report: “3 in 4 banks use API to enhance internal operation capabilities” and “1 in 3 banks on average monetize API to unlock new value”.

APIs are still young as a technical component, but they are here to stay as the backbone of IoT and take advantage of IoT’s acceleration. When experimented with different combinations, APIs may yield impossible solutions. The future seems to be revolving around combining APIs and existing microservices which will result in new hybrid capabilities or revival of existing capabilities. There is still scope of exploring the potential of APIs and letting this technology mature and further aim for some structure around standardization.

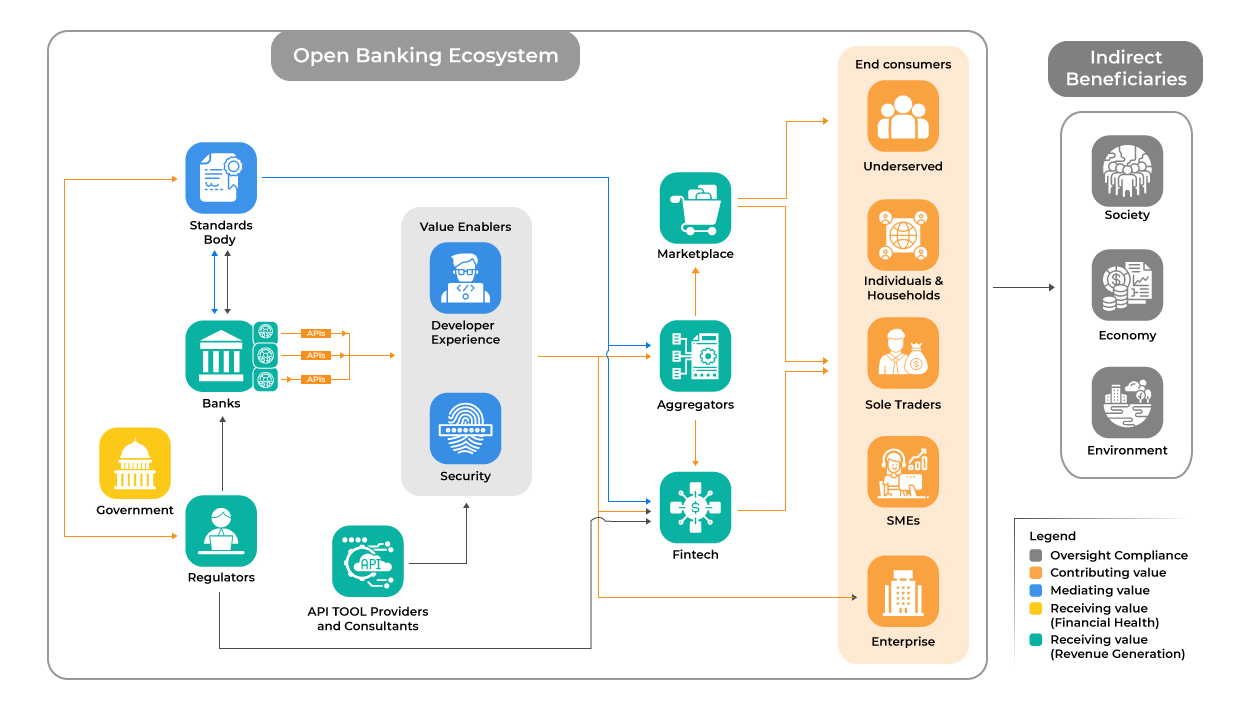

API enabled Open Banking

In a traditional banking environment, only the user and the concerned bank have access to a said user’s financial data. Open banking permits other financial service providers — either financial institutions or third-party service providers (fintech, currency exchanges, merchants, and digital banking solution providers) to use data for the user’s benefit. This unlocks the hope of having a seamless financial service interaction via apps making managing money “easier.” Open banking offers the possibility of access to one’s financial data thus enhancing tailor-made services – more relevant and greater control of the said data. It is the ability to see all the money you own on one platform so that you are smarter, effective, strategic with your money.

According to Platformable’s Platformable-Q2-2021-Open-Banking-Open-Finance-Trends, by the end of Q2 2021 globally there were 1,455 trackable open banking API platforms 2020) offering 4,831 API products which at Q2 2020 was 247 open banking platforms offering 1,995 API products- an annual growth rate of 489%.

Open Banking brings the two worlds together with technology and scope to expand offerings to new and existing customers. Panamax's Graphical User Interface (GUI) based API modules offer easy API integration, unmatchable security as well as uncompromised personalization of the new modules. Panamax is known for its experimental ways around APIs and dedicated services to find the right fit not only for banks but for authorities and government bodies.

While we wait for the latest changes to happen and amaze us with the newness by pushing technical boundaries, it seems APIs will never miss their fair chance to push the old weary ways of celebrating services out of the way. APIs and their subtle ways will continue to make space for valid discussions around technical needs which challenge developers for better, seamless, cost-effective yet innovative programing solutions aligned to enhance our current digital financial solution platforms.

Related Blogs

The API Led Evolution of Fintech – An Insight

The Role of Open APIs in the Banking Sector