Recently the word 'Open' has turned out to be a catchphrase for banks and financial services – open data, open APIs (Application Programming Interfaces), open banking, and so on. ‘Open’ defines the commitment of businesses to provide their services across the globe, so that key stakeholders or even competitors may utilize them to provide a better customer experience through digital ports.

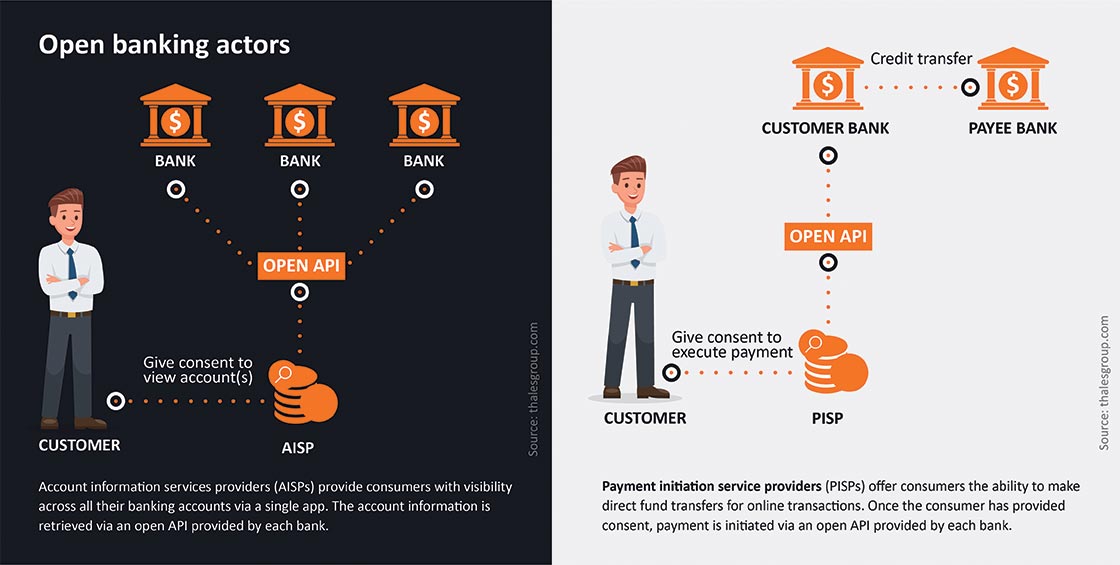

The banking industry across the world has realized that Open Banking APIs redefine the financial landscape in many ways, especially by enhancing total consumer engagement and increasing revenues from new channels. Open Banking API permits financial institutions, to share data often through a third-party application.

According to a report published by PwC, there will be a considerable rise in the adoption of this technology across the industry with 71% of small and mid-size businesses going for Open Banking by the year 2022.

How Open APIs are Improving Banking Services?

- With an Open API, banks can upgrade and improvise the existing offers and services.

- The open bank APIs can also easily connect with other APIs in the market to enhance service offerings by implementing native fintech solutions in a plug-and-play manner.

- Banks that do not use open APIs to improve their customer's digital banking experience miss out on potential customers, revenues, technological innovation, and market impact.

- To provide customers with control of their data, banks have deployed advanced open API technology to share the financial data with third parties.

- APIs enable customers to monitor the credit score on their bank account in real-time and notify banks whether a consumer has changed the address, or whether an already existing address is available for delivery.

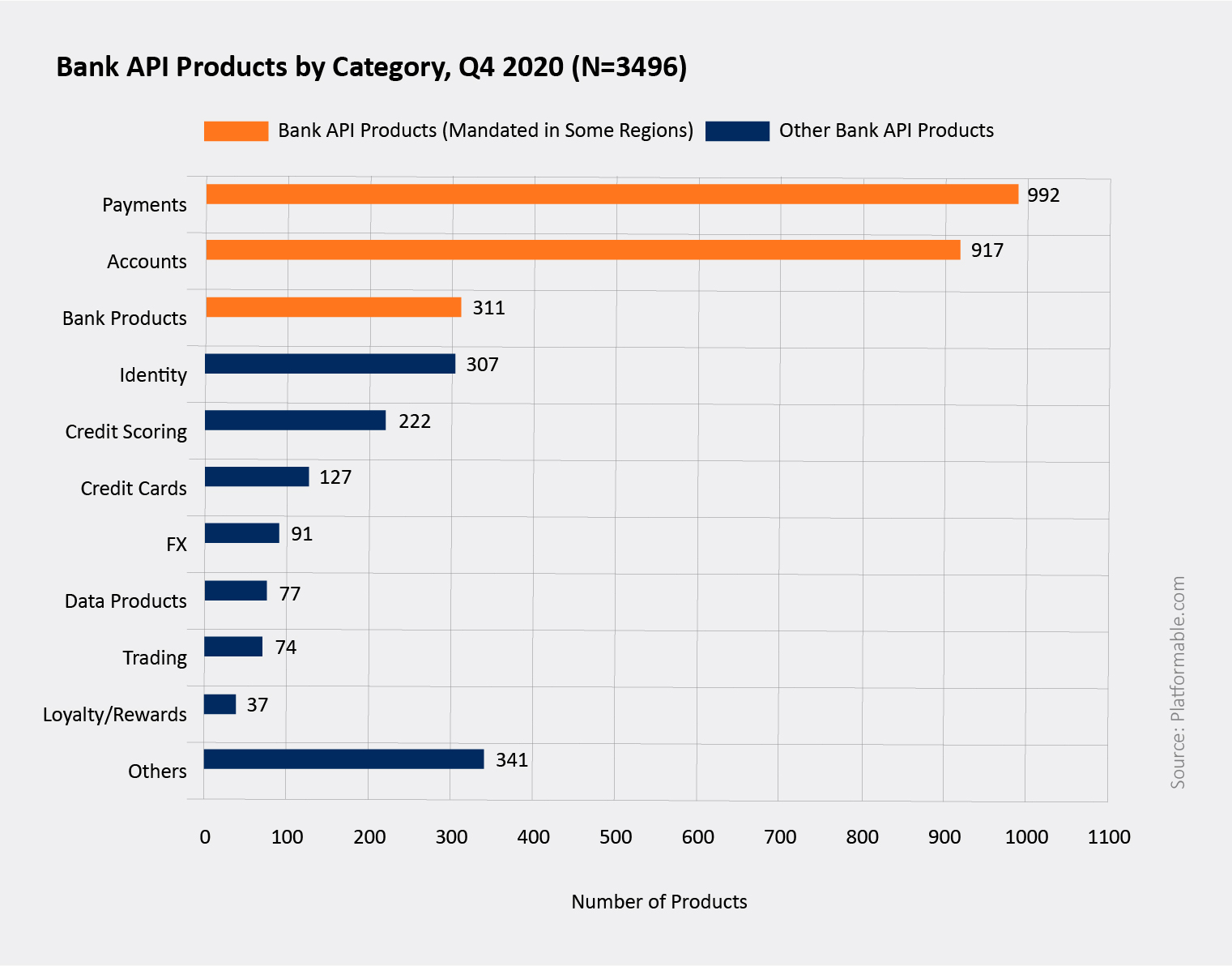

- Before the end of 2020, 3496 Open Banking API products were made accessible worldwide, with 36% of API products exceeding regulatory criteria.

- These APIs allow fintech product range to be produced and utilized by existing bank customers in automated workflows to drive Open Banking in 2021.

The significant role of APIs in Open Banking initiatives cannot be underestimated. APIs are a business channel in the new Open Banking ecosystem. Banks can grow and improve their services and offers through the adoption and use of APIs. These APIs, however, can potentially change the scenario of the banking industry by opening doors to fintech companies, which can use the data to enhance their products.

Open APIs are the Future

Open APIs are now having a growing impact on the global banking sector and things are expected to continue this way. This is especially possible because Open Banking has been encouraged not just by banks, but also by authorities and government bodies. Let’s understand how banks are moving ahead with open APIs:

Smart Technology Innovation

If banks use Open Banking APIs to link their financial data to third-party applications, a specialized team of fintech innovators can reduce the time to build technological innovations. Internal teams can work together to accomplish the project, while fintech companies are committed to perfecting their procedures in order to provide the perfect financial solutions for customers.

Reduce Expenses

Banks with open APIs also reduce the need to develop costly in-house technological platforms by effectively outsourcing the job to experienced and cost-effective fintech organizations.

Customer Insights

Open Banking APIs enable fintech companies to connect with consumer data of financial institutions to identify important trends and patterns and that is where the value of fintech's PFM (Personal Financial Management) expertise is at the forefront. With the availability of actionable data, which is increasingly refined, banks that use Open Banking APIs are definitely ahead of conventional banks that do not employ customer analytics as a service.

Customized Offers

Open APIs can provide customized financial services with open access to customer financial trends and patterns. fintech needs access to customer data before artificial intelligence is used to analyze it and develop personalized recommendations which enhance customers' engagement with financial products and their inclination towards digital banking platform.

Take the Final Leap with Open Banking APIs

The value of Open Banking and the critical significance of APIs is already revealed to financial services companies. Traditional banks acknowledge the necessity of developing their technological skills and the fact that they must not be disconnected to prevent new competitors with better offerings and services to become more successful in the sector.

Panamax's Core Banking System performs basic bank transactions such as credit processing, loans, standing instructions, deposits, and much more effectively. Our Graphical User Interface (GUI) based API module offers easy API integrations. It enables customers to control their accounts better, while assuring secure, reliable and fast transactions from wherever they are.

Related Blogs

The New Age Technologies Reshaping the Banking Industry

Open Banking: Bridging the gap between Banks and Cutting-edge Technology