In today's digital age, technology leads the change in nearly every industry, whether it is the usage of smartphone technology, automation to enhance system parameters, collaborative cloud computing, or predictive analytics to gain insight. The intelligent use of technology plays a pivotal role in improving business efficiencies.

Digital Banking report indicates that 75% of the financial institutions believe that they are ‘not adept’ and are using data analytics to decide their immediate best strategy. Regardless of this performance gap, the explosive growth of predictive personalization is a popular trend for success in the digital transition in 2021. The banking sector too has witnessed major transformation and is becoming increasingly technologically driven. Many financial Institutions are seeking to keep up with the newest tech developments, such as Blockchain, API integration, Artificial Intelligence, the platformification of analytics, and so on.

In the early adoption of digital banking technology, strategies have been moved towards a more customer-centered banking focus. Since banking institutions emphasize on developing relationships and increasing business activities, there are prominent attributes that will enable digital adoption in order to achieve customized, effective and advanced banking.

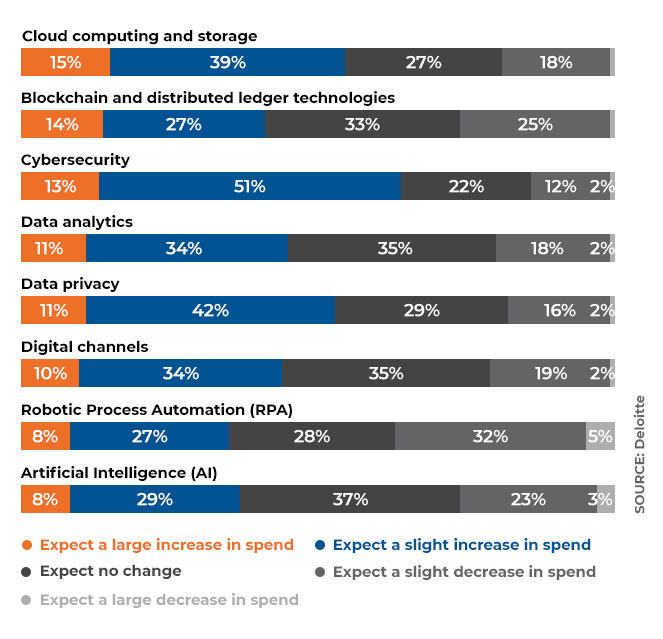

As per a survey by Deloitte, retail banks are highly focused on providing the best customer experience ensuring data protection and security. The evolving digital banking ecosystem allows the customers to access their data on applications, online portals and other digital platforms, while the pressure is on banks to comply with the increasingly strict regulations while keeping up with the demands of the customers.

Technology Spend Analysis for 2021 in Retail Banking

The only winning factor with so many competitors fighting for consumers is to monitor and quickly adopt the latest tech trends before the competitors bring about a mighty shift in the banking industry. Here’s a look at some new-age technologies that are reshaping the banking industry.

Blockchain

Blockchain technology gained prominence due to its usage in cryptocurrencies like Bitcoin, that are reviving security in transactions. As per Insider Intelligence, 48% bank officials considered that emerging technologies such as blockchain and AI (Artificial intelligence) had a great impact on the banking sector throughout the year 2020.

Speaking of banking security, blockchain would certainly disrupt banks by ensuring safety, saving costs, and enhancing customer experience. Since blockchain technology is very safe and simple to run, it can be utilized for openness and transparency in bank transactions and payments. Here are some of the important use cases of Blockchain technology for Banking sector.

P2P Payments

Blockchain uses a decentralized ledger system for peer-to-peer (P2P) money transactions and removes the problem of a geographic limitation, which means that both the sender and receiver are not required to be at the same location.

Customer KYC and Fraud Prevention

Blockchain also helps to secure consumer’s personal and financial data by storing it in several blockchain servers along with the information on real-term payments and profile details.

Clearance and Settlement

The decentralized technology blockchain allows banks to settle transactions directly in a blockchain network. They don't have to rely on custodial and regulatory services at all.

Loans and Credit

Blockchain lending is a safer way to provide personal loans to a wider pool of customers and it makes the credit process more cheap, reliable, and safe.

Digital Bank Account

Banks are heavily regulated and must comply with a range of laws such as Anti-money Laundering (AML) and eKYC standards while ensuring aggressive risk evaluation. These factors suggest that when welcoming a new customer to the fold, a certain number of procedures are needed. Some are legally binding, and some are internal policy issues. As banks move to the digital turf, the regulatory criteria have to be met. These measures can sometimes make the onboarding process complicated. The technological evolution however has simplified the process of digital account opening.

Digital Authentication

This technology allows authentication of AI-powered IDs rather than relying on industry visits to display the ID or knowledge-based verification which poses detailed questions. Customers of a bank click a picture of themselves and their ID proofs and allow the rest to be done by the technology. This also ensures unique identity of the customer is captured through various biometric modalities like iris, palm, fingerprints, face or voice.

Online Forms

Customers can easily complete documents digitally through comprehensive intake technology. The customers now receive a text message from their bank with a link to the online form which can be easily filled up over their device without the need for any bulky documentation.

API Banking

The advent of the Application Programming Interfaces (APIs) technology in the banking sector has led to substantial changes in financial operations. API is typically used for the tech interface between software programs. This interface allows a third-party application to connect to the resources and services of a bank.

API first banking consists of a series of protocols that allows other third-party companies to access banks' services via APIs. This encourages both banks and third-party firms to increase their additional specialties and services by themselves.

How API First Banking is useful:

- Enhanced outlook of cash flow, cash position, and more in all currencies with real-time abilities.

- Reduced administrative obstacles in the management of finances such as applying for a loan and testing credit ratings.

- Overview of all your finances when monitoring, tracking, and analyzing all financial movements.

Omni-channel Banking

Omni-channel banking is taking connected banking to another level by involving an amalgamation of personalization and digitization. It involves a seamless and constant movement across multiple channels ensuring there is no loss of data or experience. Omni-channel is based on the big data technology, which is sufficient for banks to extract actionable insights efficiently and rapidly. This meaningful information helps banks in enhancing the customer experience and can be of great value in providing smart, personalized service and effective promotional offerings.

Multi-channel Approach

Based on multi-channel approach that enables every device access consistently across channels any time and everywhere, omni-channel enables interactions across multiple consumer contact points that record intents, provide feedback and maximize conversations. Banks can not only meet customers' specific needs through omni-channel banking but can also predict their preferences.

WhatsApp Banking

As a part of the omni-channel banking strategy, WhatsApp has become a forum for banks to interact with their customers and take their digital operation a notch ahead. Customers can receive alerts, transaction notifications and bank offers via WhatsApp banking services. In the future, it will be more competitive, but the early tech-adoption will always have an edge over competition.

To have that edge over competition, Panamax offers WhatsApp banking solution that simplifies banking as conversation with peers. It provides the customers with all the important banking facilities, available 24x7 at home.

The Way Forward

As the pandemic broke out, most financial institutions turned to digital turfs, to enable customers to access banking services without visiting banks in-person. Banks must rethink the definition of new-age banking with the use of data analytics, technologies, and new innovations in order to transform consumers' experiences. The online banking revolution is the fact now. It seems like there is nothing which can overturn these new-age tech adoptions for banks, followed by a steady rise in improvements to banking services and the step forward towards a cashless society.

Related Blogs

Top 6 Banking Trends for 2021 and Beyond

Neo Banks: The Perfect Confluence of Technology & Banking