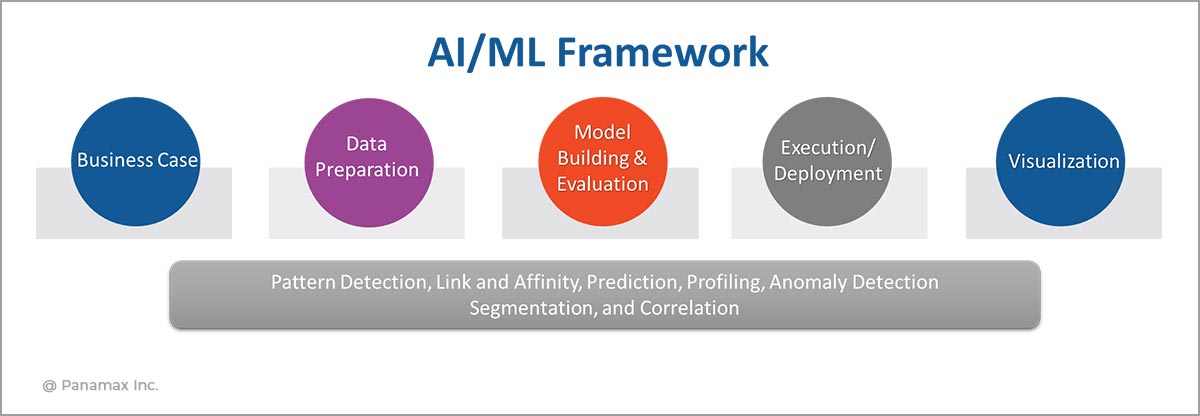

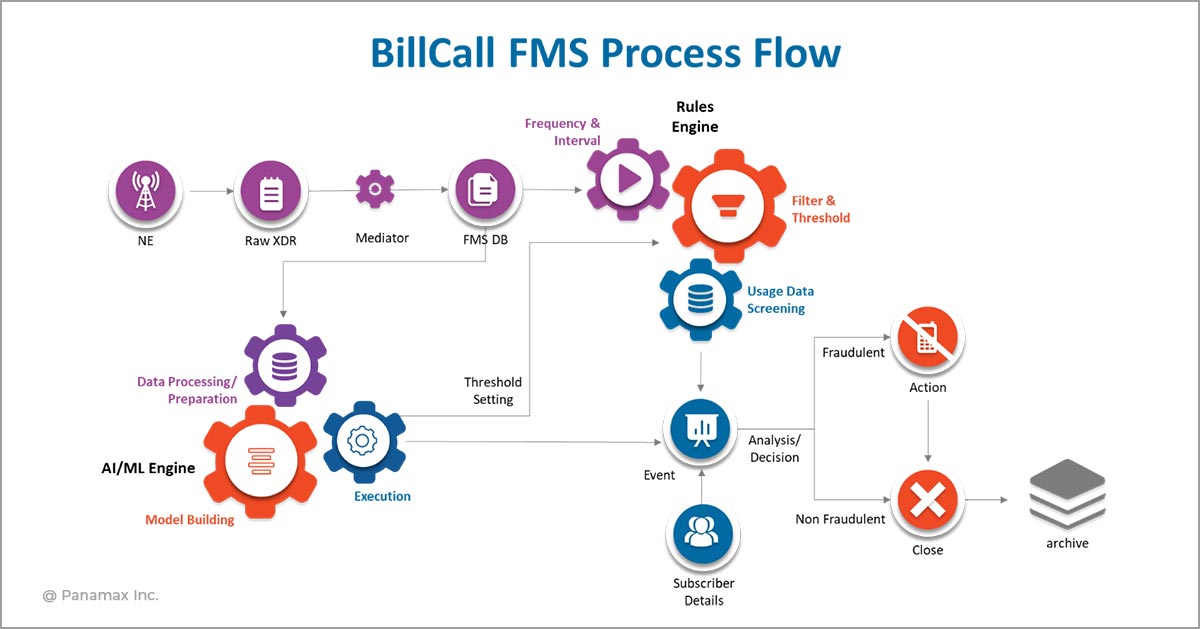

There was a time when the telecom operators depended on CDR analysis in order to identify any frauds. We are now witnessing advanced fraud management systems in place that can identify different fraud patterns based on improved self-learning technologies. In this blog we will discuss the AI/ML technologies that can be used to identify frauds.

Key AI/ML Techniques to Predict Telecom Frauds

Data Modeling

- Supervised Model - Widely used form of machine learning for all types, based on transactions accurately marked. In this model, the transaction data is properly identified and marked as fraudulent or non-fraudulent transaction. This model is based on historical data set that understands the behavioral pattern of the data likely to be fraud or clean.

- Unsupervised Models - Identifying the anomalous behavior where there is a lack of supervised model data or access to only a small set of supervised model data. In these cases, a form of self-learning must be carried out to understand the unorganized transaction data. Unsupervised models are designed to learn outliers that represent previously unnoticed usages of fraud. AI-based practices identify behavior anomalies by detecting transactions that do not adapt. For accuracy, these differences are calculated at the distinct level.

- Real-time Behavioral Profiling - Machine learning that understands behaviors of Subscribers, Carrier, Trunk, IP, Called and Calling Numbers, Mobile Money Events, Dealers, Devices, and so on.

- Supervised Machine Learning - Built and tested with large sets of non-fraudulent and fraudulent transactions.

- Unsupervised Machine Learning - Self-learning AI that constantly learns and senses outliner events and behaviors.

- Adaptive Analytics - Constantly updates the machine learning models based on feedback from fraudulent event analysis.

By selecting the best combination of supervised and unsupervised AI/ML techniques, you can detect previously unseen usages of fraudulence while quickly identifying the more intelligent patterns of fraud that have been previously experienced across millions of transactions, Trunk, Carrier, Account, Mobile Money, etc.

Behavioral Analysis

In a scheduled timeframe machine learning can understand new behavioral patterns for each event (Calls, SMS, Subscriber Profiling, Carrier, IP & Mobile Money, Wallets or Trunk) with the information getting tracked into each profile of Call, SMS, Subscriber, Carrier, IP & Trunk. The profiles get updated with every event through behavioral analysis.

- Transaction Profiles - Conduct an ML based profile of each subscriber, carrier, IP, Trunk, Wallet, or event, whether monitory or non-monitory

- Collaborative Profiles - To check and identify the gaps between individual profile groups

- Conduct Shorted List - Deep learning check, identify, score and rank each unique identity such as making calls to a specific number in a day, week, month; international calling to specific numbers, cash-in, cash-out from unique merchant or agent and regular P2P or recharge of service by user, agent or merchant.

- Carrier/IP/Trunk/Dealer/Agent/Merchant Profiling - With cumulative event (Volume Minutes/Calls, International Calls/SMS Count/Minutes) Cash-in, Cash-out, P2P or Merchant Payments from behavioral benchmark

- User Define Profiles - Easy-to-use and flexible rule-based profile creation each type Subscriber, Carrier, IP, Tunk, Wallets, Merchant, Agent, Device, and so on.

- Global Profile - To improve fraud identification with real-time monitoring, scoring and ranking of risky profiles.

To detect the fraud, AI relies on raw data from different sources and feeds from the supervised model hence generating the fraud scores. These characteristics represent the incidental patterns or integration within the data that are often learnt with machine learning. Data scientists or fraud analysists with large experience in the domain will improve the leaning process by evaluating and filtering the transaction data using a combination of modeling data and predictive analysis data for accurate analytics.

Why do we need Fraud Analytics Experts?

Several fraud management solution providers ignore the importance of fraud analytics experts when designing and developing the models. Instead, they rely on basic behavioral pattern models, that take longer time to detect the fraud patterns based on newly created events. For instance, an SME from Greater London area is using only local calls and fewer international calls during weekdays. Over weekends, however, we see a surge in international calls from their IPPBX to some high cost destinations. An efficient telecom fraud management system in this scenario will take only a couple of seconds to identify this unusual behavior and broadcast the message for a faster remedial action.

Another example could be of a mobile money user doing a regular cash out from specific location and agent with an approximate amount known to the system. Suddenly, the cash out from this user’s wallet happens to another agent from a distant city with an amount considerably higher than the regular pattern. The fraud alert mechanism in this scenario will help identify the anomaly and report it in real time.

Contributing Writer: Manasi is a content creator and developer at Panamax Inc. A post graduate in Journalism, she has dabbled in various domains in last 10 years of her career.

Read Also

Understanding Telecom Frauds

Telecom Frauds Under a New Garb: How They Look Like Now?

Is Fraud in Interconnect Business Eating into your Profits?

Conquer Financial Frauds with Thriving Technologies