From the onset of the Smart device revolution, we moved from ‘I don’t buy stuff online’ to ‘I prefer this app over that, for shopping.' In this fascinating and dynamic economy, adoption of finance technology is rapidly increasing. In this scenario, if you have not already embraced the change, it is high time for you to start thinking about implementing a robust digital finance strategy for your business.

Today the buzz around Mobile wallets is rapidly increasing, and we can see the rise of a mobile Wallet Culture across the landscapes. mPayment using mobile wallets is getting main-stream and has become the popular mode for making cashless transactions, thus slowly transporting the culture of making card payments out of fashion and into oblivion.

Using Mobile Wallets is simple. It allows an individual to pay using a mobile device, with a single touch, swipe or tap.The chief reasons why consumers have shed all inhibitions and are using mobile wallets:

• Redemption of store coupons and discount offers at participating businesses

• Easy identification and availability of location specific or real-time offers or discounts

• Availability of search directories and ratings of nearby restaurants and shops

• Freedom from keeping credit/debit cards organized and safe

• Availability of best offers on products and merchandise

Plus – Your data remains highly secure and confidential!

Above all, Mobile wallet solution wins globally over others in a single case! Unlike credit/debit cards, a Mobile Transaction restricts the exposure of the confidential data, bypassing any risk of document forging, this makes the process of making payments, highly reliable and secure.

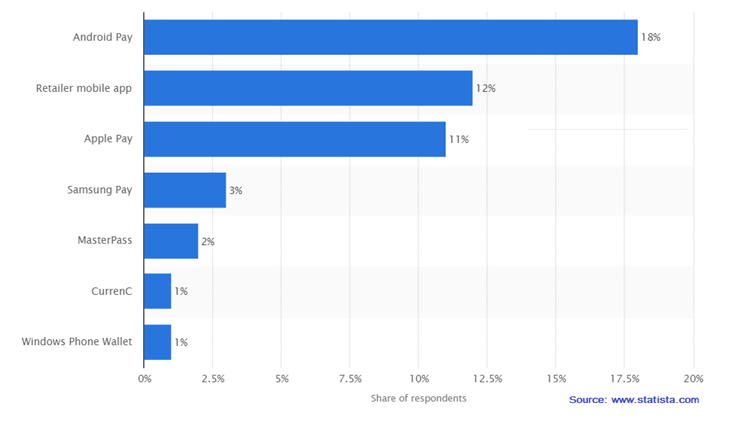

Besides, Mobile Wallets allow merchants and brands to capture user behavior and customer information, enabling them to weigh in those factors carefully to provide real-time customized and targeted marketing to their customers via mobile devices, thus proving to be a highly versatile solution. At present, the mobile payments market exhibits enormous potential. However, the finance-processing world is not content with just collaborating with the emerging technology for mobile payments. They are taking a step further, creating their own applications and services, thus competing for a widespread market acceptance. Among them come the traditional credit card processors, online payment solutions, brick-and-mortar retailers, and even the telephone network carriers. Some of the top players/adopters in the industry are: Apple Pay with iOS (and the Apple Watch), Android Pay for Android, and Samsung Pay for Galaxy mobile devices. During a survey in 2016 in the United States, 18 percent of respondents were reported to have used Android Pay in the previous year. Let’s look at the stats below:

What ties all of these competing services of mobile wallet together is the strategy behind them. They’re all designed to integrate with the platforms of their respective companies. The idea is to change the relationship between retailer and consumer by offering a more personalized experience. For instance, instead of walking into a coffee shop to buy a cup of coffee, users will receive an offer for a better deal, such as 12 cups of coffee for the price of 10, which they can purchase in advance and redeem whenever they like.

However, there are still some players and stakeholders who are resistant to adopting the technology, as they are still skeptical about the security and safety while making mPayments using mobile wallets. With numerous digital wallet options available, retailers and consumer product companies are uncertain on what approach to pursue. Nevertheless, they need to decide soon whether to switch to a complete mobile wallet platform, wait or risk being left behind.