Banks and fintech companies are exploring new opportunities that are leading to a transformation in the way they interact and engage with their customers. The generation has shifted to a mobile-first engagement due to the high-velocity technology innovations and the impact of the COVID-19 pandemic. This shift has enriched the customer experience as well as the delivery of services and products by banks and financial institutions.

One of the transformational innovations in the banking industry is open banking. The concept of open banking is expected to continue to flourish as it has the potential to increase the scale and pace at which banks function by manifolds. Through open banking, banks can share financial information electronically and securely with licensed providers via an open API. This allows banks and fintech to build and provide new applications and services that are personalized to the customers’ needs and demands. API is a tool which is now used by banks and fintech companies to allow their software applications to communicate with one another.

What can Fintech Companies and Banks Achieve via Open Banking?

Driven by collaborations and partnerships, open banking allows banks and fintech companies to co-exist and not view each other as adversaries. Through this collaboration, banks can utilize the cutting-edge technologies provided by the fintech companies to develop innovative APIs that can supersede legacy products. Banks can therefore decrease costs and provide their customers with seamless experiences along with competitive prices with their digital banking solution. At the same time, fintech companies are benefitting by being associated with a bank’s trusted name and large customer base.

Banks are benefiting from open banking capabilities in the following ways:

- Banks can now pull in fintech capabilities to speed up digital transformation process through open banking concepts.

- Ability to enhance digital presence by delivering more self-service to mobile banking, AI-powered financial management, smart e-KYC solutions, and more.

- Open banking allows banks to enable contactless payment mechanisms and go beyond digital wallets by incorporating payment-enabled ecosystems surrounded by banking and non-banking third party providers to fulfill their customer's mobile banking needs.

How are Customers Benefitting through Open Banking?

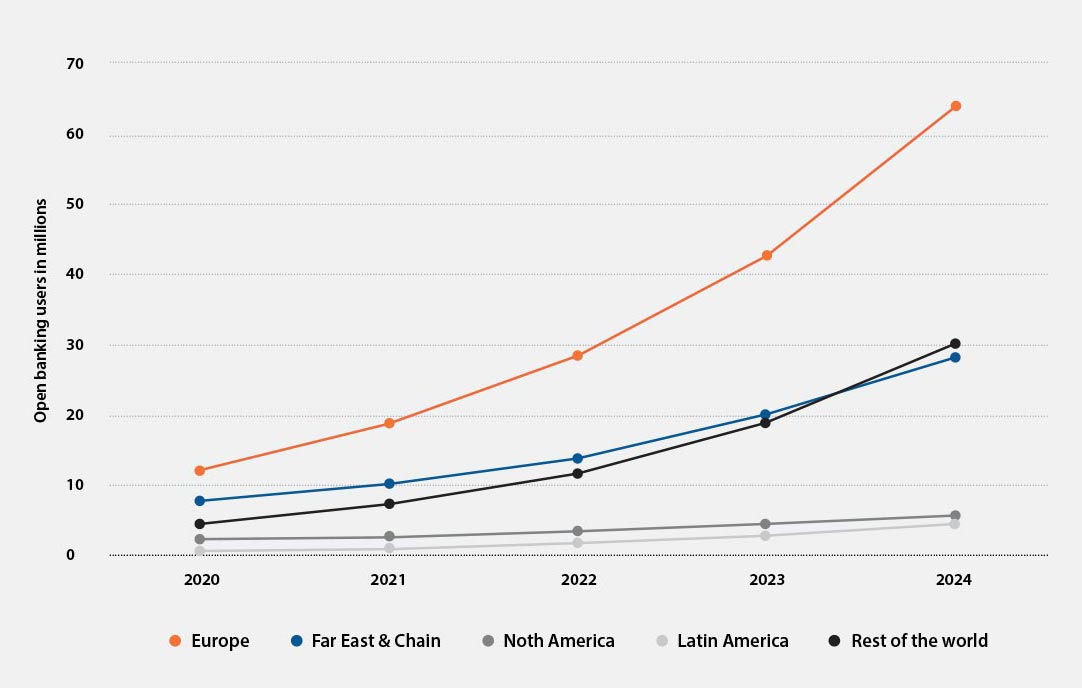

In the pre-open banking era, banks and financial institutions offered limited options and standard services to all their customers. Through open banking, customers have the freedom to select from multiple service providers available and can take charge of their finances to make informed decisions while managing their accounts. According to a research by Statista, the number of open banking users globally is expected to grow at an average annual rate of nearly 50 percent between 2020 and 2024, and the European market is expected to be the largest.

Let us look at how banks are simplifying and enriching customer experience by deploying open banking.

Quick Payments through Smart Devices

With open banking APIs in mobile banking solutions, customers do not have to wait in long queues to make purchases with physical wallets at stores. It allows e-wallet application users to make payments from their smartphone or even smartwatch.

Ease in International Remittance and Currency Exchange

Migrants spread across the globe in different countries for better financial opportunities and growth resulting in a continual increase in the amount of money sent back to their families. Banks have always found international money remittance to be a difficult and expensive process. Thanks to Open API, banks can now make the whole process much simpler, smoother, less expensive, and faster for their customers.

Avail Personalized Product and Service Offerings

Open banking can be employed to offer personalized and relevant product and service options to the consumers which most banking apps cannot do. End-users of banking services can get more personalized services and product offerings based on the analysis of their data related to their financial habits and behavior. Open banking APIs have successfully established the concept of offering service personalization in banking that is benefitting customers and enriching the user experience immensely.

Other Benefits of Open Banking to end-customers include-

- End-customers can now avail access to multiple accounts in one place.

- Users can get the best deals available along with greater transparency.

- The solution gives customers the opportunity to check and review their current financial position on a single application in their smartphone.

- As all the financial data of the end-user is in one place, it is possible to use it in making crucial credit decisions and avail the best deals.

The Evolving Face of Banking Services

As banks are becoming more vigorous in adopting new technologies, there is plenty of room for fintech and banks to prosper and grow parallelly. Open banking and other technologies are changing the way we bank and offer the opportunity to drive innovation by connecting developers with data that was earlier locked and hidden.

Panamax’s Banking Suite offers a holistic digital banking experience with innovative features and end-to-end solutions that improve operational efficiencies. It allows banks and financial institutions in delivering contemporary digital banking services to their customers and facilitate online banking, hence reducing infrastructural expenses.

Related Blogs

Neo Banks: The Perfect Confluence of Technology & Banking

Open Banking: Bridging the gap between Banks and Cutting-edge Technology