Agent banking has gained a lot of traction in areas where it is not feasible for banks to open full-fledged physical branches due to cost, manpower, network unavailability, or other constraints. The underdeveloped and developing countries have benefitted immensely from the emergence and outreach of agent banks as they help underbanked and unbanked come under the financial spectrum.

People from underserved or remote areas often do not have access to bank branches or traditional setups to avail the benefits provided by banks and manage their finances. They not only are being devoid of basic banking facilities that are easily available to a considerable part of the population around the globe, but also do not get access to other facilities such as microfinance, e-lending, tax support and more. Agent banking aka agency banking or branchless banking works towards bridging this gap.

How does Agent Banking Work?

Agent banking entails creating a network of agents or non-bank retail providers that bring essential banking facilities to the doorstep of the underserved. The agents are usually armed with Point of Sale (PoS) card readers with barcode and biometric scanners or a mobile phone which can be used for carrying out a range of banking services such as cash-in/cash-out, P2P money transfers, remittances, balance checks, loan installments repayments, mini statements and much more.

All the three entities involved in agent banking – banks, agents and customers – have a lot to gain from this model. The banks successfully reach a number of people who weren’t in the financial spectrum, and at a fraction of a cost considering that they are not required to set-up full-fledged bank branches in remote locations. The bank in turn generates employment or additional income for agents and the customers benefit by gaining access to financial services which were unavailable to them.

Fintech Adoption in Africa

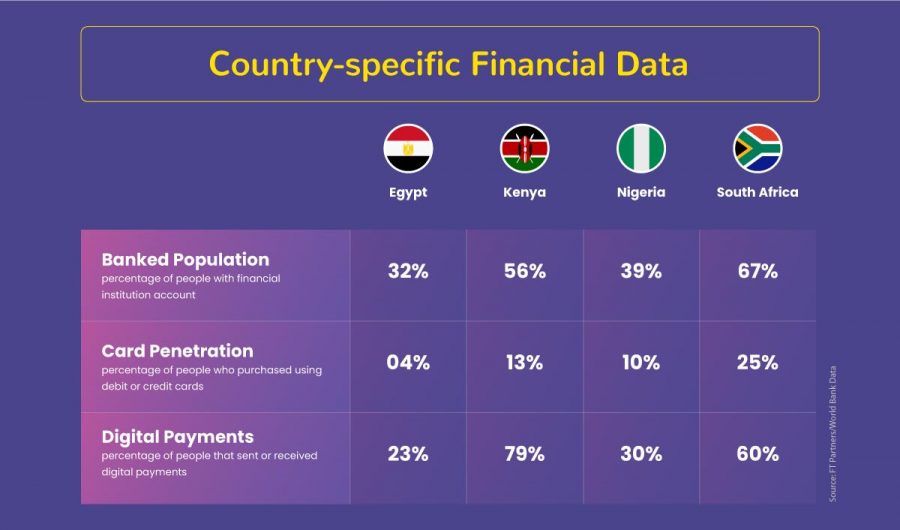

Africa has the world’s fastest growing population as well as the world’s fastest growing middle class segment, according to FT Partners Fintech Industry Research. About 65 percent of the total population of Africa is under 35 and this majorly young demographic makes it easier to introduce and spread technologically advanced services in the continent. Africa also has a mobile penetration rate of around 80 percent and an internet penetration rate of 36 percent. The region has merely 4.5 bank branches per 100K people, which is being compensated with the expansive agent network that has successfully been implemented across the continent.

The continent of Africa is currently home to 491 fintech startups, up from 301 in 2017, according to the Finnovating for Africa report by Disrupt Africa. South Africa, Nigeria and Kenya are leading the pack by accounting for 65.2% of the total fintech activity in Africa, but the rest of the African countries are also witnessing a rise in the local fintech ecosystems. Fintech startups have collectively raised $320 million since January 2015, with nearly $132.8 million in 2018 itself, making it the sector’s best year so far.

These startups have a huge role to play in developing the agent banking network of Africa. Banks and financial institutions are tying up with companies who have developed advanced and secured technology solutions to help financial inclusion in the continent.

Role of Agent Banking in African Economy

Traditional financial institutions are unable to meet the demands of fragmented markets and a population that is largely dispersed in various remote locations across Africa. Another challenge faced by the rural population is a lack of financial literacy and their inability to get low-value transactions processed at branches or ATMs which tend to be far off and congested. An agent banking network is equipped with resources to address these challenges and help the unbanked. Let’s find out how this model helps drive financial inclusion of underserved and unbanked.

1. Doorstep Assistance

Agent baking addresses the major challenge for people from rural and remote locations, that is, travelling to bank branches which are usually located in areas far from their villages. By developing an agent network, financial institutions effectively deliver doorstep assistance without incurring the costs of setting up branches.

2. Enhanced Security

Cashless income when deposited in a structured financial institution tends to be safer than it is in the form of cash. The agent banking model makes sure even low-earning individuals can save their money to get some financial security as well as returns on their deposits.

3. Ability to Manage Finances

Managing finances is a challenge for people who do not have access to financial services, and more so for low wage earners. By depositing a part of their earnings to their digital accounts, people can begin to build savings or access credit in case of emergencies in the future.

4. Availability of Financial Products

The agent banking model brings everybody within the financial fold, thus making financial products and mobile money services available to all. A digital financial account holder finds it easier to avail microfinancing, loans, insurance, investment options and more, as compared to their unbanked counterparts.

5. Quick Access to Banking Services

Banking services that were traditionally only available through bank branches are brought to people in the remote locations in an affordable, secured and convenient fashion. Agent banking ensures that everyone gets quick access to basic banking services like cash withdrawals, cash deposits, balance checks, fund transfers and more, regardless of their geographical location or proximity to a bank branch.

Related Posts

Why is Agency Banking the Silver Bullet for Financial Inclusion?

African telecom provider trusts Panamax to accelerate its operational efficiency

Scope of Agent Banking in 2020

Agent banking has a widespread reach in Africa, but a significant population still remains devoid of basic banking facilities. The focus of banks and financial institutions in 2020 should be to deliver last mile financial services to those who continue to remain unbanked. Special programs for women can also be designed and distributed on a large scale to bring them within the financial spectrum and set the ball rolling for social equality in remote locations. Judging by the success of this model, it can further be expanded to include new banking services and financial products along with the basic services.