In recent years, banks have started to doubt the effectiveness of passwords in safeguarding their clients' financial accounts. Passwords are also viewed as antiquated and unsafe by users, especially when used on mobile devices. It gets easier to crack passwords when users generate easy to remember passwords, such as birthdate, pet name or any other personal detail. There are instances where passwords are shared with multiple users due to multiple access. These are big risks, but things are different with biometric authentication, as it’s near to impossible for a person to guess or share biometrics. Therefore, biometrics will eventually overtake passwords on mobile platforms, according to tech experts, and the finance industry is expected to lead the change.

At present, biometric devices and authentication applications need physical verification through face recognition, thumbprint, palm, or iris to unlock or log in. Apart from that, behavioral biometrics are also growing with tech advancements in Artificial Intelligence (AI). Tracking and identifying irregularities and security threats based on the behavioral pattern of biometric profiles has become easier for the finance industry and governments.

For years, security and fraud prevention businesses are trying to get rid of the passwords. They consider passwords as a weaker security option due to the human error element, as people often use passwords that are easy to crack or identify. Similar PINs (Personal Identification Number) are used for multiple accounts on personal and professional fronts. There is a chance of passwords and PINs being stolen, whereas it is relatively difficult in the case of biometric authentication such as voice recognition or fingerprint scanning.

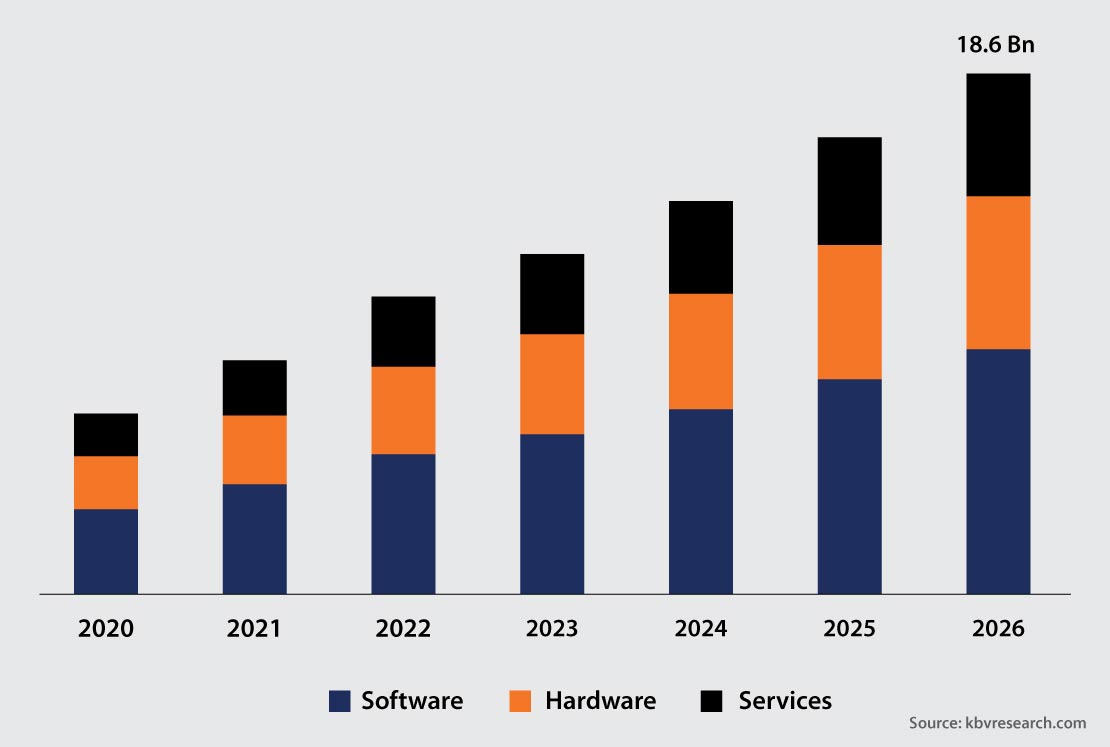

Global Contactless Biometrics Technology Market Size

Businesses are looking to provide convenience and security to their customers through biometric verification systems and the pandemic has a key role to play in the global development and acceptance of biometric authentication systems. By 2026, the global contactless biometrics technology market is estimated to be worth $18.6 billion, with a CAGR of 19.1%.

The Challenge with Passwords

Passwords and PINs getting stolen is a big worry. As per the 2021 Data Breach Investigations Report (DBIR) by Verizon, 60% of the data breaches were targeted towards login credentials. Also, many users prefer the same login credentials for multiple accounts logged in through a single email ID to avoid remembering a lot of passwords at once. Ultimately, it gets easier for hackers to steal data or funds from multiple platforms by cracking the login details of the users.

Changing the password and login credentials after 30 days is not the best practice to provide a safe user experience. It gets inconvenient for users to change passwords again and again and to remember them for long. Especially, bank customers are looking for an alternative to passwords to access digital banking services.

Use of Unique Data

People use an alphanumeric password to ensure that it's not easy to decipher or copy, but passwords are generated by humans. Therefore, it becomes easy for hackers to replicate the secret code. This doesn’t happen with biometric authentication, as the physical presence of the user is required to unlock the data. Users might forget the artificially created secret codes and login details, but biological attributes and behavioral patterns remain inherent. Biometrics is a part of the digital uniqueness of the data.

Convenience of Authentication

Even though the biometric authentication procedure is technically complex, it is remarkably simple and fast from the user's perspective. Quickly authenticating an account by placing a finger on the optical scanner is faster than entering a long password with alphanumeric characters. There are chances that users might forget the password, but this won’t happen with biometrics coming into the picture.

Businesses may subscribe to Biometrics-as-a-Service via web APIs. Rather than onboarding a full-fledged team of developers and spending on a big data ecosystem to manage biometric data, banks can use web services and access their resources for convenience.

Multi-factor Authentication

Biometric modalities help to enhance the security layer with multi-factor authentication. It can be used along with login credentials or passwords. For instance, a user can use both a secret key as well as a fingerprint scan to log in or can also use a combination of facial recognition and voice recognition. Login details can be compromised due to their shareable nature, but a biometric-based multi-factor authentication can neither be disclosed nor duplicated. These functionalities of multiple authentications marginalize the risk of data breaches.

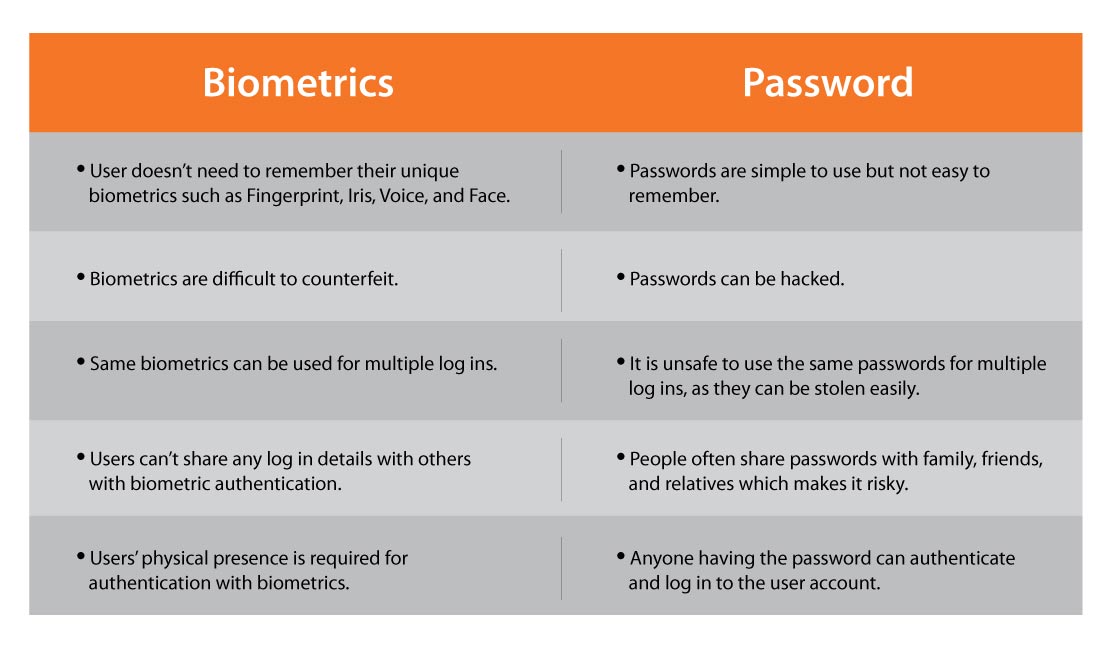

Biometrics vs Password

Get the Smart Biometric System for Enhanced Safety

Businesses around the world have started to integrate with biometric systems and passwords are losing credibility gradually. With the growing use of biometric authentication, verification of user data is executed through just scanning of fingerprints, iris, or face recognition. Banks and other players in the finance industry are using biometrics to counter frauds and security threats efficiently.

Smart Biometrics solution offered by Panamax assists businesses, governments, and API partners in storing and managing visitor or customer data. With the rise of digital transactions and participation, we recognized the importance of having a reliable authentication and authorization system for every organization and individual. Our smart biometric solution eliminates any identifying concerns, even when resources are forgotten or stolen.

Related Blogs

Ditch the Password with Biometrics Solutions

Enhance Security of Your Payments with Biometrics