Technology has touched every industry and transformed them forever and banking and fintech industries are no alien. It has constantly grown enabling them to provide an array of digitized and contactless services to the customers. The call for digital banking has turned louder and clearer with the advancement of Artificial Intelligence and Machine Learning in the tech world.

The pandemic has a pivotal role in the acceleration of digitization of the banking sector. As governments across the globe implemented lockdown and social distancing, banks adopted the digital way. Many experts believe that pandemic has encouraged banks to think and come up with a futuristic Digital Banking strategy in a short period.

Customers across the globe prefer to select those stores which allow them the ease of contactless payment. As per The Visa Back to Business Report, 63% consumers around the world opt for a new business that has invested in contactless payment options amid the COVID-19 crisis. Almost half of the global consumers won’t buy anything from those businesses that only offer a cash payment option. These data suggest that digital transactions and contactless payments will further expand their reach beyond expectations in the post-pandemic age.

Deciphering Contactless Payments

Contactless, as the word says refers to ‘no-touch,’ is a process that does not need any physical contact of a card or mobile phone with a PoS (Point of Sale) device.

Radio-frequency identification (RFID), a widely used technology based on electromagnetic waves, supports contactless payment systems. This technology utilizes memory chips that store information or ‘codes’ along with RFID readers to decrypt the code. Physical objects in direct range can communicate with each other with the use of RFID. Delivery monitoring, inventory control, and toll collection are only a few of the functions that these devices are used for.

Another technology used for making contactless payments is Near Field Communication (NFC), a subset of RFID, which allows the customers to make contactless payments and enables the communication between cards/mobile phones and the PoS system when they are within a specific range. It indicates a customer can make a payment by bringing the card or mobile phone near the PoS device and when there is a green light signal or a beep to notify the payment, the transaction is considered completed. Using this technology, customers don’t have to sign in or enter a PIN (Personal Identification Number) to make payments.

Post-COVID Contactless Payments

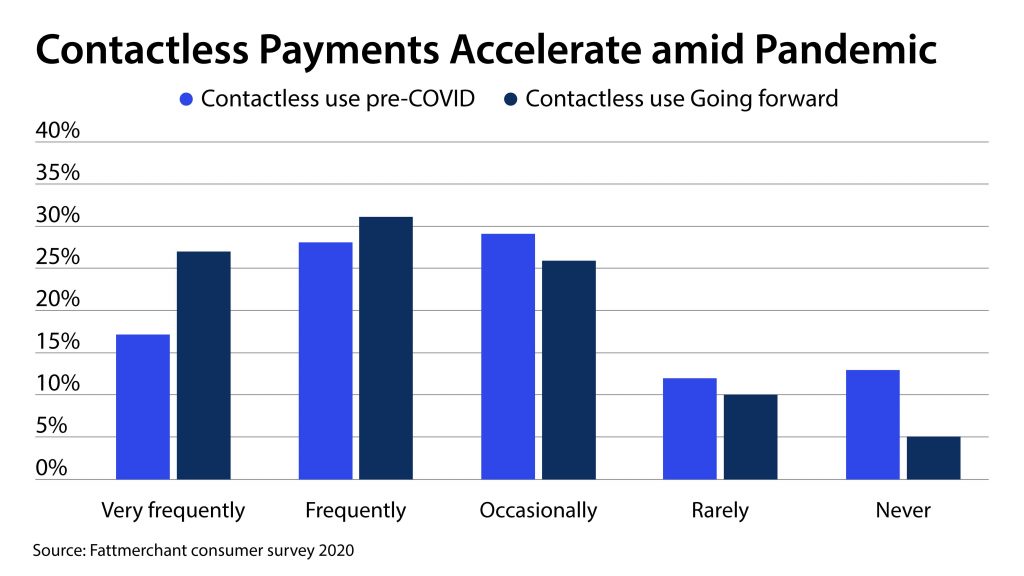

World Health Organization has already highlighted the fact that the physical currency notes and coins may act as a COVID-19 super spreader. Contactless payments are one of the most potential impacts of the pandemic that will stay for a long time.

More convenience, favorable governmental policies, and evolving customer behavior have contributed towards the growth of digital payments over cash. As per a study by ReportLinker, over a period 2021 to 2026, the digital payment market will expand at a CAGR of 13.7%.

A survey of 17,000 respondents from 19 different countries by MasterCard, shows the preference of contactless payments for hassle-free transaction. Banks are considering this data to create a renewed payment strategy focused on evolving digital financial landscape.

Here are some ways Contactless Payments can benefit:

Faster and Convenient Transactions

Contactless payments largely reduce the transaction time. A chip-enabled card may require 30 to 45 seconds to complete a transaction, whereas the contactless transaction may just need 10-15 seconds. The customers don’t have to enter the PIN manually. Faster transactions not only save the customer’s time but also lets the banks and FIs focus on their operations rather than having to attend to long queues at their branches.

COVID Safety with Touchless Capabilities

During the pandemic period contactless payments are witnessing a steep rise. Customers have the advantage of making payments through mobile wallets or cards without any physical touch involved, minimizing the risk of getting infected.

Fraud-resistant Mechanism

The use of NFC technology doesn’t allow any data leak while executing a transaction. While making a payment, the customer’s card information is transmitted in the form of a one-time encrypted code while the cardholder’s name and security code are not shared with the payment processor.

Enable Contactless Payment to Avoid Market Loss

Over the next few years, contactless payments will witness a considerable rise leading to rapid developments in this domain by the banks and fintech companies bringing in disruptive technology. Almost every credible market survey on payments that identifies cashless transactions as an outcome of the pandemic is likely to cause trouble for banks that refuse to use contactless payment technology or provide multiple payment choices at the PoS.

The Banking Suite by Panamax allows you to create a comprehensive digital banking experience for the customers with groundbreaking features. Digital banking platform enables banks and financial institutions to provide online banking services to their customers while maintaining low infrastructural costs. With over three decades of extensive experience in providing secured Digital Financial Solutions, Panamax is constant redefining innovation, security and usability in fintech services.

Related Blogs

Todays & Tomorrows of Mobile Payments

Orchestrating Contactless Fuel Payments