Artificial Intelligence (AI) has a great potential in transforming and enhancing fintech and banking in a variety of ways. Banks and fintech companies are using a range of AI technologies to increase business efficiency and provide more personalized services.

Finance and accounting departments in banks and fintech companies are overburdened with data management and are forced to deal with a never-ending stream of regulatory obligations that keep changing on a daily basis. With AI data analysis and statistical features, the processing of unstructured data can be significantly accelerated, and relevant information can be identified easily to achieve faster compliances.

AI also has the ability to add value to company workflows, enhance employee skills, and leverage the power of humans and machines to enhance customer service in both the short and long term, as well as through backend and front-office applications.

According to McKinsey Analytics, the estimated annual value of AI and analytics tools across industries maybe somewhere between $9.5 trillion and $15.4 trillion. The AI advantages, such as cost reductions, operational efficiencies, increased protection, or an increase in creativity, are benefitting several industries.

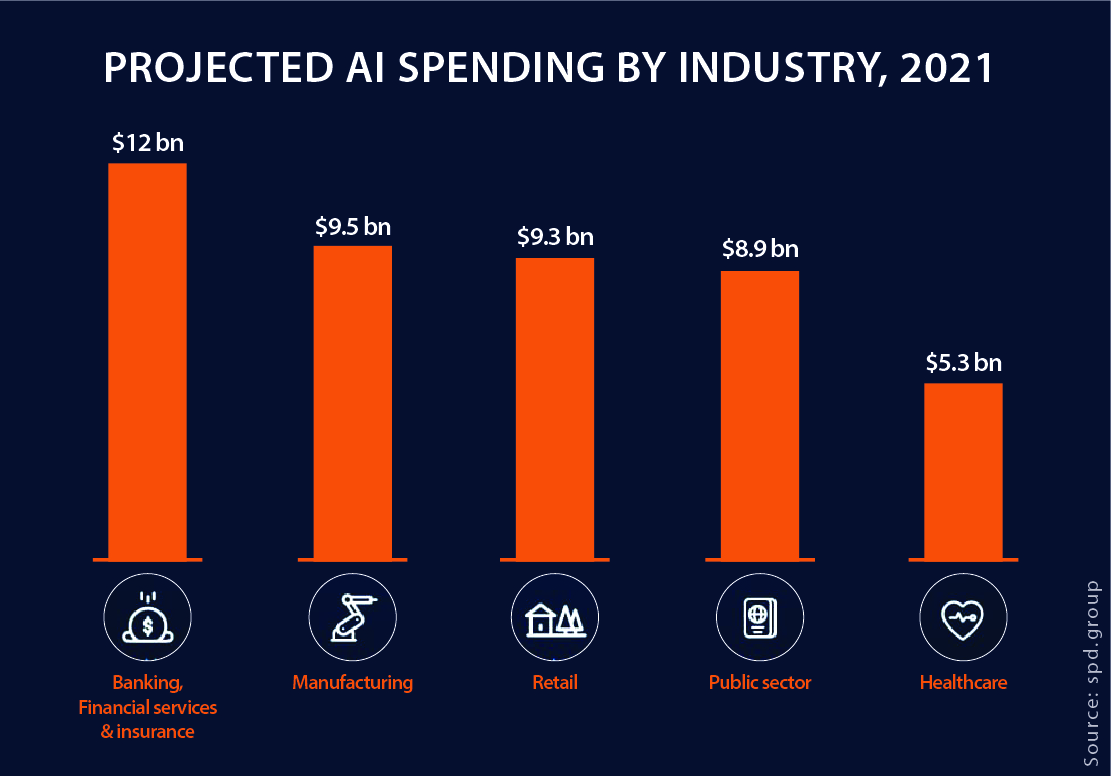

This year, the banking, financial services, and insurance industries (BFSI) are expected to spend over $12 billion for AI technology investments, greatly outpacing other businesses.

Expected AI Investments by Industries in 2021

Here we’ll discover how banks and fintech industries are leveraging AI to create a resilient business model.

AI in Banking Industry

AI is becoming more and more integrated with the businesses around the world, and banks must employ AI at the same pace to be equally competitive by transforming their whole capabilities stack, including the engagement layer, core system, data infrastructure, and business model, to become ‘AI-first’ in their vision and operations. Banks are expected to save $447 billion by 2023 with the use of AI technology.

Let’s discover how banks are currently implementing AI in their operations:

Data Analysis

Data collection and analysis are performed efficiently with AI-based apps. AI-based applications for mobile banking gather data and develop a suitable learning mechanism to greatly improve the customer experience making it more personalized after a thorough analysis of the information.

Machine Learning - Chatbots

Chatbots are interactive interfaces that are powered by artificial intelligence. These chatbots engage with millions of users on the bank's behalf without incurring significant costs. Customers prefer mobile apps to conduct financial transactions, therefore banks integrate chatbot services into them. It allows them to capture the attention of customers and establish themselves as a market-recognized brand.

Fraud Protection

AI can assist in both preventing and detecting fraud by analyzing customer behavior in real-time to identify unusual transactions. With the accuracy and capacity to prevent fraudulent transactions, AI can examine more of the second and third-party data to investigate the authenticity of transactions and strengthen the verification process through biometric-based technologies.

Risk Management

A bank may face issues if it lends money to insolvent consumers. Default occurs when a borrower loses a steady source of income. To avoid this amount of default, AI-powered systems can more properly assess consumer credit histories. Financial transactions are tracked, and consumer data is analyzed via mobile banking apps. This enables banks to foresee hazards associated with loan issuance, customer insolvency, or the possibility of fraud.

AI in Fintech Industry

Fintech organizations have been rapidly implementing smart solutions to cope with the industry's changing terrain in recent years. AI and ML (Machine Learning or ML is a subset of AI) have nearly completely penetrated almost every aspect of business, from backend operations to front-end functions.

The value of AI in fintech is predicted to reach $22.6 billion in the next five years with a CAGR of 23.37%.

Let’s discover how Fintech Industry is using AI to provide better customer experiences.

Predictive Analytics

Finance professionals rely on effective cash planning to appropriately support their distribution accounts, make timely borrowing or investment decisions, manage target balances, and comply with all regulations. Predictive analytics uses ML, data mining, and modeling to predict future occurrences and improve cash forecasting using historical and real-time analytical methodologies.

Process Optimization

Process optimization, is already one of the most widely used AI and ML applications in the fintech industry. It helps the business reduce the amount of manual work performed by staff and improves the efficiency of the process, resulting in increased output. It's frequently used to automate call-center activities, improve employee training, and minimize paperwork for customer-facing chatbots.

Automated Systems

Robotic Process Automation (RPA) is being used by small business owners to automate a variety of repetitive processes, such as data extraction, storing documents, regulatory compliance, and accelerating the cash management process. The technology combines various data sources to discover transaction patterns and categorize expenditure automatically, using a mix of ML and custom rules, processes and calculations to assist small business owners with back-office functions such as accounting and payroll management.

Algorithmic Trading

Trading frequently entails assessing data and making quick decisions. ML algorithms are excellent at evaluating data of any amount or density. The only requirement is enough data to develop the model, which trading provides in spades (market data, current and historical). The algorithm recognizes patterns that are difficult for humans to notice and reacts faster to execute trades automatically based on data insight.

Conclusion

The possibilities for AI development in banks and fintech industry are virtually limitless. Both industries will benefit from AI and associated technology's improved decision-making, intelligent automation systems, deep insights, and real-time predictive analytics capabilities.

The industry-leading WhatsApp Banking Solution from Panamax, allows bank customers to access all of the financial services in real-time, 24x7. Banks use our conversational AI banking solution to enable financial services such as Alert and Notifications, Mini Statements, Debit/Credit Card Details, and Card Blocking for Fraud Prevention.

Related Blogs

Artificial Intelligence and Bots – The Next Step to Achieve Automation

The New Age Technologies Reshaping the Banking Industry